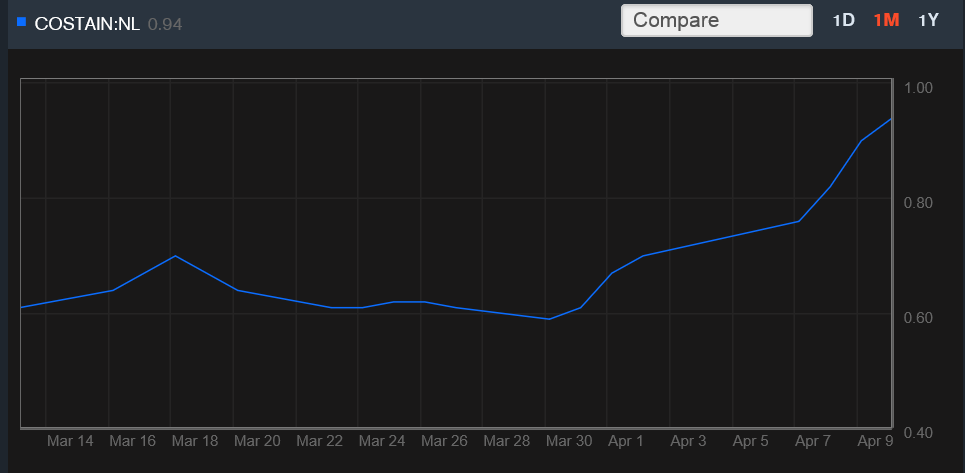

At the end of trading last week, Costain came out tops as the stock with the most gains for the week. The share price gained 38% to close at 94kobo making it the highest gainer for the week. So, is there anything to suggest there is still an upside? First thing you do is to figure our why the share price ramped up last week.

Fundamentals – Costain from our records has not released any Financial Statement since December 2012. Based on that we do not have any financial information that may have influenced the rally that we are seeing in the share price. The last time Costain was in the news (from our records) was back in January 2014 when the company it had paid back its loans to First Bank helping the stock to a 70% plus rally to close then at about N2.18. After that the share price has continued to plummet until things started to change again last week.

Technical Analysis – This perhaps may explain the reason for recent rally we are seeing with Costain. All TA indicators suggest the bullish run was a technical play with investors who depend on charts and other technical indicators to decide whether to buy a stock depending on the perceived signals they are getting. TA can sometimes either drive up or bring down the value of a stock regardless of whether there is a fundamental justification for that or not.

Buy, sell or hold? The TA analysis that we have seen suggest the stock still has some bullish upside meaning the share price still has room to rise. However, the risk of it dropping far outweighs the risk of it rising in our view. In addition, a stock that has no fundamentals at the moment certainly does not provide any comfort as regards share price increasing the risk further. If you also do not know how to play TA or don’t have a Stockbroker that can help guide you then your risk of entry and exiting on a high is even ominous.

Opinion: Sell

Disclosure – Nairametrics and the author of this article does not own shares in Costain (WA) Ltd and does not plan to buy shares in Costain (WA) Ltd in the next one week. The author of this article wrote it themselves, and did not write this article on behalf of Costain (WA) Ltd , its associates or representatives. The article is purely their opinion.