Okomu Oil Plc is a leading Oil Palm company and has been in operations in Nigeria since December 1979. The company is owned 62.69% by Socfinaf SA (incorporated in Luxembourg) and 9.96% by Stanbic Nominees. Other Nigerians own the balance. The company’s recent 9 months results showed pre-tax profits rose 28% to N2.7billion with earnings per share for the period of N2.18 on track to beat last years estimate of N2.91.

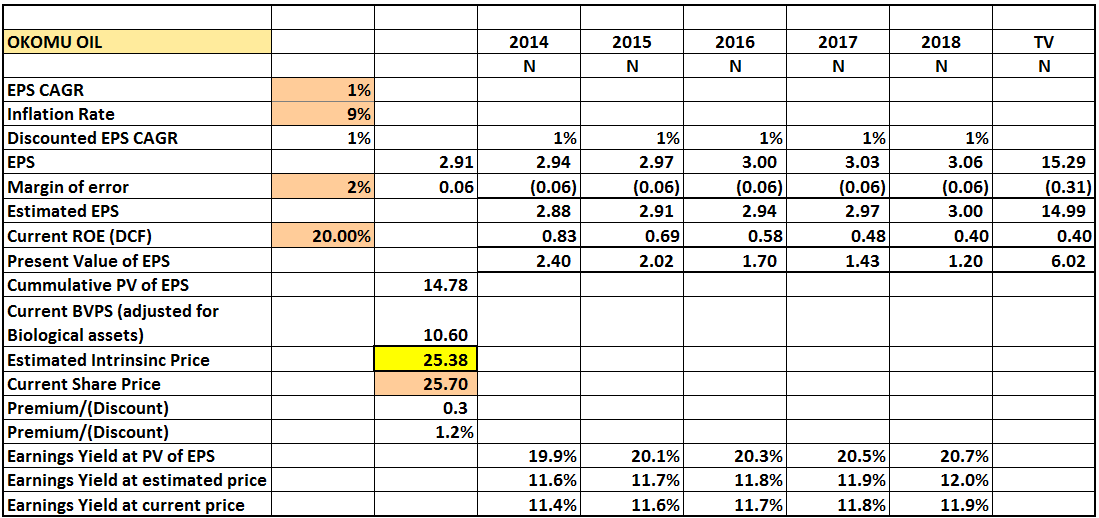

Okomu Oil currently trades at N24. 8 (after trading at an average of N35 this year) has now dropped a 37% year to date and is currently trading at its one year low. So this begs the question, is this share price undervalued or perhaps overvalued?

Price Earnings Ratio – At the current price of N26.8 Okomu Oil has a trailing P/E ratio of 10.9x and a forward P/E ratio of about 9.3x assuming it post an earnings per share of N3.1. That P/E ratio is now at a discount to the wider index but now below Presco which still has a P/E ratio of 14x. If you recall that Okomu Oil for long had a P/E ratio of 15x when it traded between N33 to N35 then this price may just be about right for the company. (Prices as at November 21, 2014)

Price to book ratio – Okomu Oil currently has a Price to book ratio of 1.1x considering that it currently has a Net Asset Per share of N25.17 (as at September 2014). Just a month ago the price to book ratio was about 1.4x. Okomu Oil’s Net Asset Per Share in my opinion may need to be adjusted to strip out some accounting classifications, thus giving you a better valuation outlook. Currently, net assets includes about N13.9billion (as at 2013) in biological assets that are included in their figure for retained earnings. These are purely IFRS provisions which captures the value of the company’s biological assets annually. This figures can increase or be impaired depending on the valuation carried out periodically.

Biological assets include land and the natural assets on it such as rubber and oil palm plantations. IFRS allows the company to regularly value those assets and record the surplus under retained earnings are deduct the impairment in value under retained earnings as well.

If you then decide to strip that out Net Assets drops to about N11billion currently or N10.6 per share taking price to book ratio to over 2x.

PEG Ratio – Using an adjusted compounded earnings growth of 6% over the last 5 years, the company will have a PEG ratio that currently stands at about 1.6x. Earnings might grow by 20% YoY by December this year, however Okomu Oil hasn’t reported a consistent earnings growth in the last five years making such a growth unusable for future projections. The volatility in the commodities market is also a factor. Also, for Okomu Oil to grow back to the N7.53 earnings per share it attained in 2012 it will have to grow earnings by a CAGR of 21% for the next five years or 37% in the next three years. That seems highly unlikely at the moment and will suggest this price already is attracting a high multiple on its earnings ability. Okomu Oil gave a one for one bonus issue in 2013 ensuring that it needed to boost profitability significantly to grow EPS.

Present value of Future Earnings – Adjusting for the accounting profits in retained earnings will give Okomu Oil an adjusted value of N10.6 makes N25 just about right.

Finally,

We bought Okomu Oil in September at about N35 a huge premium to its current price of N26. This thesis suggest the intrinsic value of this stock is in the region of N25 (If you decide to ignore the value of the Biological Assets). But for a company in Oil Palm business, Biological Assets are very valuable assets and can’t be totally ignored. Without the biological assets (comprising lands and natural assets situated on it) the company probably will not be in business. This makes the current price of N25-N26 a bargain for anyone looking to buy Okomu Oil.