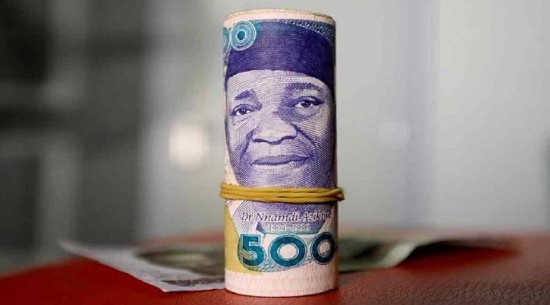

On October 4, 2024, the naira gained against the U.S. dollar, closing at N1,631.21 in the official Investor and Exporter (I&E) window, as global crude oil prices eye $80 per barrel.

This marked a modest 1.69% appreciation compared to the previous day’s exchange rate of N1,659.26, despite a sharp decrease in market turnover.

The naira’s slight improvement came as trading volume in the I&E window dropped to $238.36 million, reflecting a significant 47% decline from the $450.39 million registered the previous day.

Key Data Points

Closing Exchange Rate: On October 4, the naira settled at N1,631.21 per dollar, up 1.69% from the prior close of N1,659.26.

Intra-Day Highs and Lows: Throughout the trading session, the naira fluctuated, reaching a high of N1,679.00 and a low of N1,580.00 before ending at its final rate of N1,631.21.

Market Turnover: The day’s total turnover in the I&E window fell to $238.36 million, a stark drop from the previous day’s figure of $450.39 million. For context, September’s cumulative turnover amounted to $3.3 billion.

Parallel Market Rates: In the parallel market, the naira opened at N1,669.49 per dollar, fluctuating between a peak of N1,673.34 and a low of N1,618.00, before closing at N1,618.75.

Market Trends

Throughout September, the naira experienced sluggish movement as it struggled to stabilize amid volatile market conditions.

After trading at N1,300 per dollar in March, the currency has faced increasing pressure, particularly in August, when it hovered around the N1,500 mark. By September, the naira experienced further depreciation.

Year to date, the currency has lost approximately 75% of its value, driven largely by rising inflation and growing demand for foreign exchange.

Nigeria’s external reserves increased yet again, reaching $39.07 billion as of September 19, 2024. This upward movement in reserves offers a glimmer of hope for stabilizing the currency in the near term.

What to know

Crude oil, a crucial driver of Nigeria’s economy, showed signs of recovery in October after rebounding from September lows.

In October, Brent and Nigerian oil blends have stabilized around $77 per barrel, as tensions in the Middle East raised concerns over potential supply disruptions.

As Iran, a major oil producer, faces escalating tensions with Israel, crude oil futures have strengthened due to supply disruption fears, adding upward pressure on global prices.

What to expect

- If oil prices continue their upward trend, OPEC member countries like Nigeria could benefit from increased revenue, potentially easing economic pressures and supporting the naira’s value.

- Higher oil earnings would bolster the country’s foreign exchange reserves, likely improving market sentiment towards the naira.

- In addition, favorable macroeconomic policies could position the currency for further appreciation, especially if the U.S. dollar weakens in the global market.