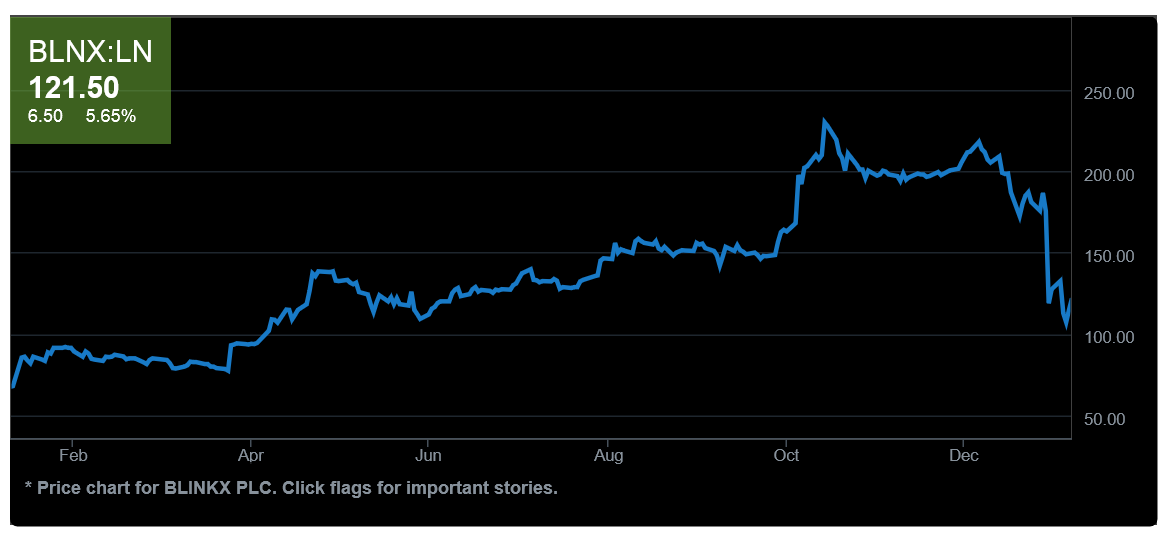

Bloomberg reports an Associate Professor of Harvard wrote a damaging blog post about Internet video and advertising company Blinkx Plc (BLNX) helping the stock to its biggest plunge ever.

The blog post is entitled “The Darker Side of Blinkx,” Benjamin Edelman, an associate professor of business administration, said his research indicated that the London-based company used deceptive software to inflate traffic counts and capture commissions. Edelman wrote that he prepared the research for an unnamed client.

Here is a damaging excerpt from the blog;

Blinkx has been equally circumspect as to the size of the ex-Zango business. In Blinkx’ 2010 financial report, Blinkx nowhere tells investors the revenue or profit resulting from Zango’s business. Rather, Blinkx insists “It is not practical to determine the financial effect of the purchased net assets…. The Group’s core products and those purchased have been integrated and the operations merged such that it is not practical to determine the portion of the result that specifically relates to these assets.” I find this statement puzzling. The ex-Zango business is logically freestanding — for example, separate relationships with the partners who install the adware on users’ computers. I see no proper reason why the results of the ex-Zango business could not be reported separately. Investors might reasonably want to know how much of Blinkx’s business comes from the controversial ex-Zango activities.

Indeed, Blinkx’s investor statements make no mention whatsoever of Zango, adware, pop-ups, or browser plug-ins of any kind in any annual reports, presentations, or other public disclosures. (I downloaded all such documents from Blinkx’ Financial Results page and ran full-text search, finding no matches.) As best I can tell, Blinkx also failed to mention these endeavors in conference calls or other official public communications. In a December 2013 conference call, Jefferies analyst David Reynolds asked Blinkx about its top sources of traffic/supply, and management refused to answer — in sharp contrast to other firms that disclose their largest and most significant relationships.

In March-April 2012, many ex-Zango staff left Blinkx en masse. Many ended up at Verti Technology Group, a company specializing in adware distribution. Myriad factors indicate that Blinkx controls Verti: 1) According to LinkedIn, Verti has eight current employees of which five are former employees of Zango, Pinball, and/or Blinkx. Other recent Verti employees include Val Sanford, who moved from Zango to Blinkx to Verti. 2) Blinkx’s Twitter account: Blinkx follows just nineteen users including Blinkx’s founder, various of its acquisitions (including Prime Visibility / AdOn and Rhythm New Media), and several of their staff. Blinkx follows Verti’s primary account as well as the personal account of a Verti manager. 3) Washington Secretaty of State filings indicate that Verti’s president is Colm Doyle (then Directory of Technology at Blinkx, though he subsequently returned to HP Autonomy) and secretary, treasurer, and chairman is Erin Laye (Director of Project Management at Blinkx). Doyle and Laye’s links to Blinkx were suppressed somewhat in that both, at formation, specified their home addresses instead of their Blinkx office. 4) Whois links several Verti domains to Blinkx nameservers. (Details on file.) Taken together, these facts suggest that Blinkx attempted to move a controversial business line to a subsidiary which the public is less likely to recognize as part of Blinkx.

Controversially Edelman, 33, added this week that he had been paid for the work by two U.S. investors to write the blog. This came after the stock tumbled and Harvard Business School, citing its conflict-of-interest policy, asked Edelman for more information. It’s unclear if the investors who paid for the research profited from its publication.

Too bad the stock already took a tumble.

![[The Nigerian Economy Daily] FG has approved the closure of five foreign missions and embassies](https://nairametrics.com/wp-content/uploads/2017/05/nigerian-economy-today-1.jpg)