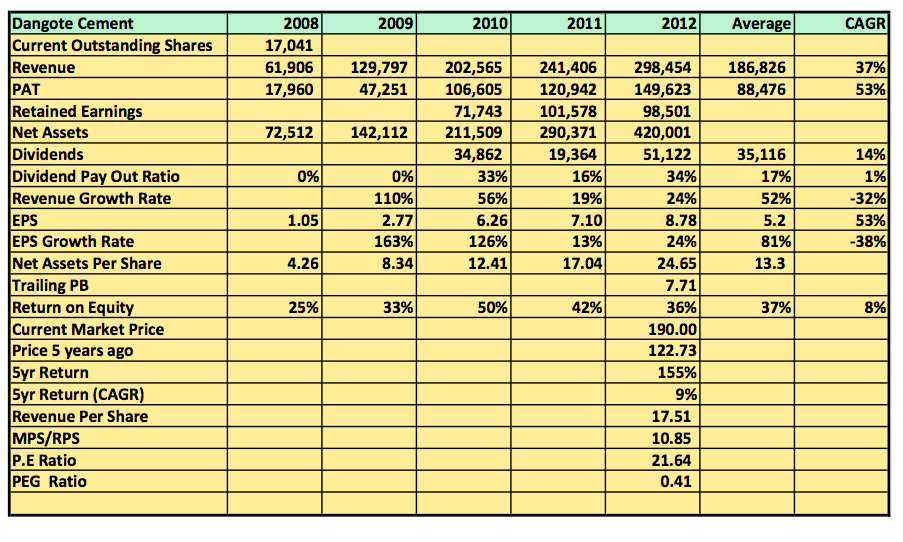

Dangote Cement Plc is one of the largest companies quoted on the Nigerian Stock Exchange by market capitalisation. In fact its market cap of N3.3tr is about one quarter of the entire NSE All Share Index indicating its remarkable size. Of its 17billion outstanding shares only about 5% of its is floating in the Nigerian Stock Exchange and available for buy and sell. The rest is held tightly by Africa’s richest man Aliko Dangote.

Dangote Cement has also been a profitable company growing revenues and profits at rates rarely seen. It makes money by selling manufactured cement which it currently produces at its Cement Plants located in Nigeria. It has a total productive capacity of 20.25million metrics tonnes of cement which is about 72% the entire productive capacity in Nigeria of 28mmt.

Assumptions

Revenues

Revenues have grown steadily since 2008 growing at a compounded annual growth rate (CAGR) of 22%. Much of this revenue growth is underlined by the company’s massive expansion drive and near complete domination in the Cement Market in Nigeria. This over the last 3 years. It’s likely this domination will persist in the near future considering the time it will take competitors to catch up. They have also expanded aggressively to areas in the country that have typically been the forte of its competitors. It’s planned foray outside Nigeria is also a recipe for future revenue growth. I am assuming the CAGR of 22% will continue to strengthen in the coming years.

Operating Expenses

Operating Expenses has grown at an uneven rate over the years. It has however grown at a CAGR of 25% over the last five years. Relative to Gross Profit, operating expenses has dropped from as high as 72% in 2008 to 21% in 2012. Much of this is attributed to the astronomical growth in Gross Profits over the last three years. This is because as revenues grew throughout the years, cost of sales increase lagged leading to a Gross Profit Margin CAGR of about 34% for the last 5 years. Despite this, I expect operating expensed to rise to 35% of Gross Profit stabilising thereafter. Much of this is as a result of the effect of depreciation and other amortisation arising from the increase in Fixed Assets as well as its buying spree.

Earnings Per Share

Earnings Per Share has risen 53% in CAGR. As with revenues the explosion in earnings began in 2009 when profits went from N26.6billion in 2008 to N63.7billion in 2009 and in 2012 Profit after tax was N135.6billion. But I don’t expect EPS to continue to grow at this rate. In fact, if you adjust the base year of the CAGR to 2009 instead of 2008, EPS Growth drops to 25% instead of 53%. In addition, finance cost can’t continue to remain at under 6% mainly due to capitalisation. Soon, it will stop capitalising its interest cost transferring same to bottom line as incurred.

Other Assumptions

- Valuation is done based on DCF of future retained earnings per share. This is added to the terminal value and the current Book Value per share.

- Expected Average Dividend Payout of 17% annually

- Buyer of the share is only a minor shareholder with no influence that can be liken to any form of control

- Expected yield is 15%

- Projected dividend is deducted from earnings to arrive at projected retained earnings

- Inflation rate is projected at 9% average for the next 5 years

- A premium of 10% is added to the DCF derived Projected Book Value per share to arrive at a higher valuation figure

- Shares bought will be held for a minimum of 5years

Share Valuation

Conclusion

I bought Dangote Cement shares for N197 some weeks back. Based on the above, the shares may seem quite pricey. However, if you substitute the 25% CAGR in EPS for the actual 53% you get a share price that is double what my estimated value is. In fact the my estimated PEG ratio is about 0.41 suggesting the current price may actually be justified. This is because the P.E ratio is smaller than the CAGR for EPS over the last five years. So I am assuming the company may continue to grow at that pace. If you adjust the CAGR to 25% the PEG ratio still drops below 1x.

No one has the monopoly of prediction when it comes to determining the future value of stocks. Follow your instincts.

NB: See link to updated valuation https://web.ugometrics.com/equity-valuation-dangote-cement-updated/

Please, can you fill me in on how you get WACC on Nigerian organizations on which you discount the FCF.

Thanks

I don’t use WACC…I instead use their trailing ROE as I value EPS and not free cash flows. However, if I were to use WACC simple take an average of their 5 yrs ROE as cost of equity or use the industry average. You then check their balance sheet for debts and divide that by average interest expense to get cost of debt. Getting the right better is probably a challenge but I most use 1.2.

Risk free rate is also easy to get as you can use 10yr FGN Bond yields or or one year treasury bills depending on your horizon. After this you can then calculate your WACC.

I will blog about this soon.

Cheers

Job opportunity Work as sales man driver, loader in dengote clement company call now 08147594183 or 08103241816 apply now

Pls can you tell us how to determine a company’s face value