Daily performance of major economic indicators and highlights from tradings sessions and key statistics such as T-bills, bonds, FX rates, inflation, oil price.

Yields Compress Marginally, with Interests on the Short Tenors

FG proposes N24,000 minimum wage

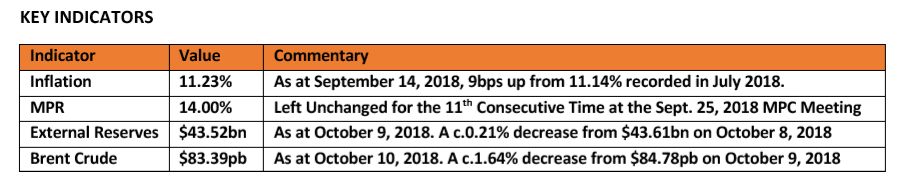

KEY INDICATORS

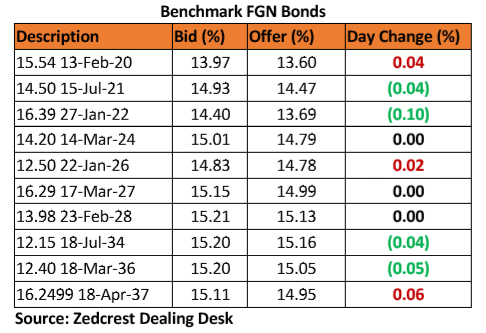

Bonds

The bond market remained relatively quiet, with yields compressing marginally by c.1bp following slight interests witnessed on the shorter end of the curve (21s & 22s). Investors also showed interests for the 2025s, whilst we saw better offers on the longer end of the curve, with yields ticking higher by c.6bps on the 2037s.

We expect the market to remain largely order driven in the near term, with clients expected to remain attracted to the higher yielding bonds +15% offers. Market players are however expected to maintain a short bias on the auction bonds.

Treasury Bills

The T-bills market remained relatively quiet in today’s session, with slight bullish sentiments observed on the short end of the curve (Oct – Jan), but with some more profit taking witnessed on the longer end of the curve (Sept/Oct) in anticipation of the OMO auction tomorrow.

We expect the CBN to conduct an OMO auction tomorrow to mop up inflows (c.N277bn) from maturing bills. We consequently expect the market to maintain a slightly bearish posture, even as market players anticipate a signifcant drawdown in system liquidity via a retail FX auction on Friday.

Money Market

The OBB and OVN rates remained relatively stable, closing today at 9.67% and 10.17% as system liquidity remained buoyant at c.N190bn positive. The slight decline in system liquidity from c.N240bn in the previous session came on the back of outflows for the wholesale FX auction, which had already been provided for on Monday.

We expect rates to remain stable, barring a significant OMO sale tomorrow.

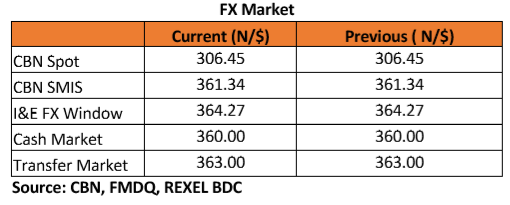

FX Market

At the Interbank, the Naira/USD rate remained stable at N306.45/$ (spot) and N361.34/$ (SMIS). At the I&E FX window a total of $285.05mn was traded in 455 deals, with rates ranging between N350.00/$ – N365.00/$. The NAFEX closing rate remained unchanged at N364.27/$.

At the parallel market, the cash and transfer rates remained unchanged at N360.00/$ and N363.00/$ respectively.

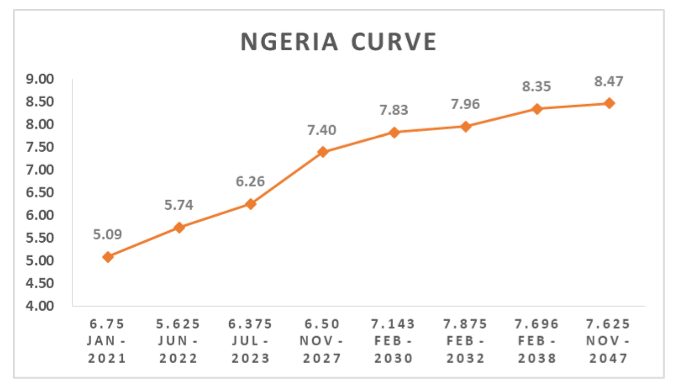

Eurobonds

The NGERIA sovereigns opened the day on a slightly positive note, but gave up gains later in the day, with yields closing c.5bps higher d/d. We witnessed the most losses on the 2038s which lost c.0.40pct in price terms.

The NGERIA Corps were conversely bullish, with the most interests seen on the shorter dated tickers. The DIAMBNK 19s continued to post gains, whilst we also saw good buyers in the GRTBNL 18s, Zenith 19s and FBNNL 21s.

Disclaimer:

Whilst proper and reasonable care has been taken in the preparation and accuracy of the facts and figures presented in this report, no responsibility or liability is accepted by Zedcrest Capital or its employees for any error, omission or opinion expressed herein. This report is not an investment research or a research recommendation and should not be regarded as such. The information provided herein is by no means intended to provide a sufficient basis on which to make an investment decision.