Italian fashion house Giorgio Armani could see a major shift in ownership structure after the late designer’s will instructed heirs to either gradually sell stakes in the company or pursue a stock market listing.

This marks a significant departure from Armani’s longstanding insistence on independence.

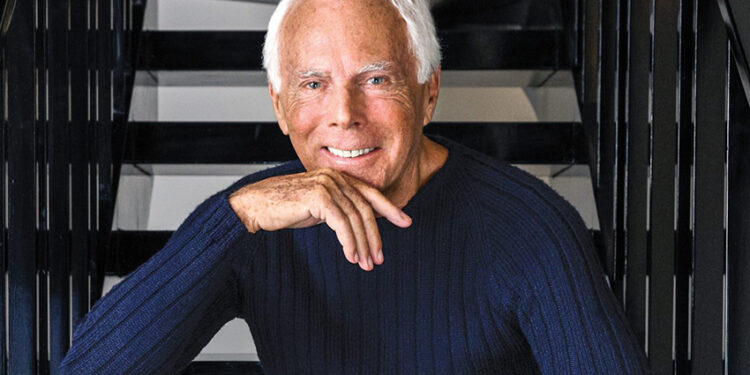

Armani, who died on September 4 at age 91, left no children to directly inherit his empire.

His will stipulates that heirs sell an initial 15% stake in the company within 18 months. This could be followed by a transfer of between 30% and 54.9% of shares to the same buyer within three to five years. In an alternative scenario, heirs may opt for an initial public offering, either on the Milan Stock Exchange or another international bourse of “equal standing.”

Priority buyers, according to the document, include luxury conglomerate LVMH, beauty group L’Oréal, and eyewear leader EssilorLuxottica. The mention of these France-listed giants shows a notable shift from Armani’s previous insistence on independence and Italian ownership.

The designer, who built his global reputation on sleek, unstructured suits and minimalist aesthetics, had rejected numerous acquisition approaches over the decades, including an approach in 2021 from John Elkann of Italy’s Agnelli family and earlier interest from Gucci under Maurizio Gucci.

What you should know

Armani personally maintained majority ownership and tight control over both the creative and business sides of the company until his death.

Financially, the group remains stable but not immune to sector pressures. In 2024, Armani generated revenues of €2.3 billion ($2.7 billion), though profitability has been squeezed by the broader slowdown in global luxury spending.

Governance going forward will rest largely with the Fondazione Giorgio Armani and Armani’s longtime business and life partner, Pantaleo Dell’Orco. Together, they hold 70% of the group’s voting rights, while the foundation itself will retain a 30.1% stake should a public listing occur.

The new ownership roadmap reflects both legacy preservation and the realities of succession planning in Italy’s luxury sector.

With no direct heirs, Armani seeks to balance financial stability, brand continuity, and potential global expansion. Reports note that giving priority to France-listed conglomerates signals a pragmatic openness to cross-border ownership, even if it contrasts with Armani’s nationalist stance in life.

The eventual outcome, whether a sale to a luxury giant or a listing, will determine how one of Italy’s last independent fashion houses navigates an increasingly consolidated global luxury market.