Article summary

- Wema Bank raked in N6.1 billion from its electronic banking channels in 2022 as more customers were onboarded on ALAT.

- This represents a 79% increase when compared with the N3.5 billion the bank generated from electronic channels in 2021.

- The bank, however, acknowledged that the increase in its electronic transactions had also led to an increase in complaints from its customers.

Wema Bank recorded a boom in its electronic banking channels in 2022 as it generated N6.1 billion from digital platforms. The bank disclosed this in its 2022 audited financial statement recently released.

The 2022 e-banking revenue represents a 79% increase when compared with the 3.4 billion the bank generated from electronic channels in 2021.

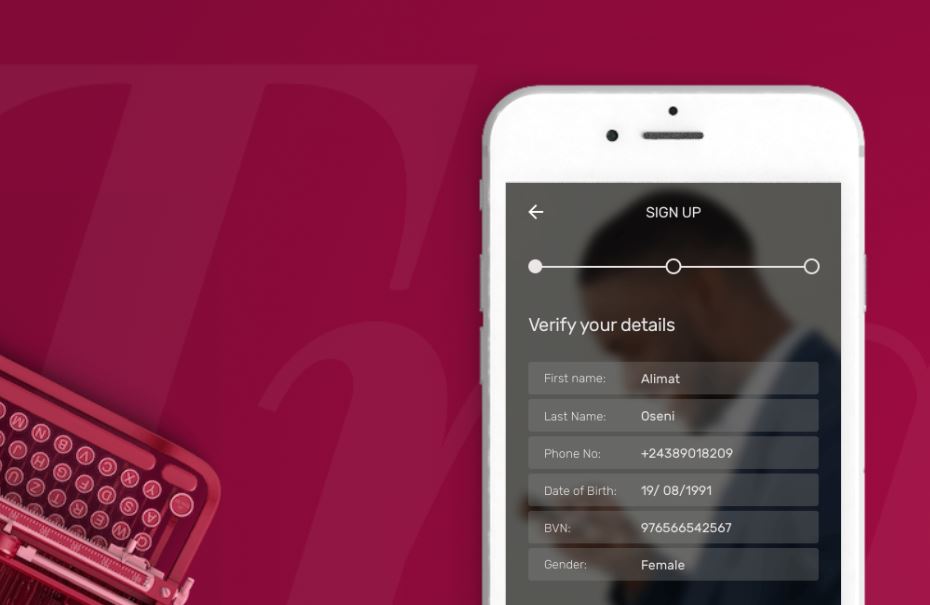

Behind this growth is the bank’s digital banking platform, ALAT, which gained traction and attracted more customers in the year under review. According to the bank, ALAT recorded a 131% increase in the number of customers onboarded in 2022.

In addition, Wema Bank said its other card products also recorded a 98% increase in the number of new customers within the year.

The key success driver

Speaking on the bank’s financial performance and the crucial impact of its electronic banking channels, Wema Bank’s Chairman Board of Directors, Babatunde Kasali, said:

- “ALAT continues to be a key growth driver and success story for the Bank, recording a year-on-year increase of over 853,092 in the number of actively transacting customers on the platform. With the rollout of new and innovative features on ALAT, and our ALAT For Business platform, we are sure of increased growth and heightened performance on both platforms in the coming year.

- “Wema Bank has always worked to put its customers first and meet their needs every step of the way, whether through their local bank branch or through ALAT, the digital banking platform. We will continue to work towards our goal of becoming Nigeria’s dominant digital banking platform, an objective that requires an unwavering focus on our digital business, a key lever for customer acquisition, retention, and engagement.”

Increase in customer complaints

Meanwhile, the bank observed that the increase in the use of its electronic channels has also led to an increase in the number of complaints received from its customers. It, however, said the complaints are being resolved promptly.

- “While the growth in the level of adoption of our alternate/digital channels by customers has posed its own challenges, most notably the increase in the number of customer complaints received, the upgrade of the infrastructure/technology powering our contact center (Purple Connect) during the course of the year and the upscale in the skill set of our agents have ensured that customers’ complaints are resolved promptly with very minimal disenfranchisement reported,” the bank stated.

In case you missed it

Last week, Wema Bank Plc released its audited financial statements for the year ended 31st December 2022, revealing strong financial performance despite macroeconomic headwinds.

The bank’s profit before tax grew by 20.25% to N14.8 billion as against N12.37 billion posted in 2021. The interest income went up 44.43% to N108.03 billion from N74.7 billion posted in 2021, driven by strong growth in Net Interest Income.

According to the bank’s financial statement, Net Interest Income rose by 35.9% to N54.2 billion from N39.8 billion in 2021 driven by growth in earning assets while Operating Income was up 31.5% to N74.4 billion from N56.6 billion in 2021.