The GDP report by the National Bureau of Statistics explained that the Real Estate Services and Construction sector jointly contributed 9.40% of Nigeria’s real GDP in Q1 2021. Till date, a large portion of the numbers recorded by the sector, typically comes from Lagos. One would expect that with the high commercial real estate activities in Lagos, issues like housing deficit should be at least minimal.

However, in spite of the relatively high market activity and increased private sector participation in the sector, Lagos State has not been able to meet up to 50% of its housing demand, and the number of informal houses continues to increase. In this article, we analyse three critical numbers that paint the true picture of the State’s housing deficit.

Despite increased development activities in Lagos, the State still needs over 3 million residential units to meet demand.

Despite increased development activities in Lagos, the State still needs over 3 million residential units to meet demand.

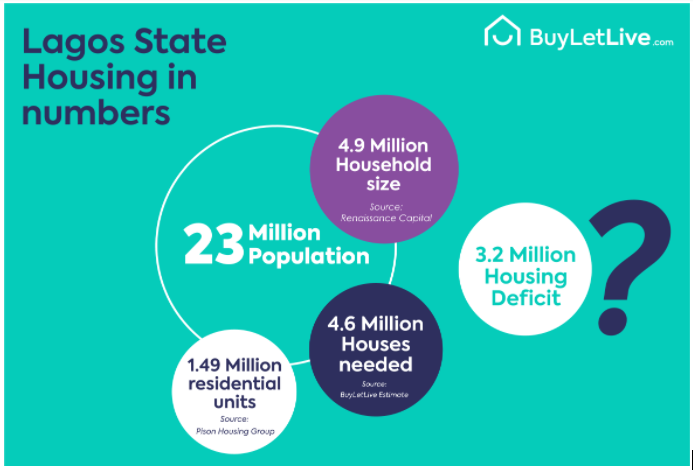

A population of 23 million, a household size of 4.9 people, and a housing stock of 1.49 million units, these three numbers paint the true picture of Lagos’ housing deficit. According to publicly available data, Lagos’ population as of date, is estimated at 23 million. Renaissance Capital in its 2019 36 Shades of Nigeria Report also estimated the State’s household size at 4.9 people. This means that you will find 4.9 people on average in each household you see in Lagos. Looking at both data closely, Lagos needs at least 4.69 million residential units to cater for its population. On the surface, that may sound like a small number, but when you juxtapose these numbers with Pison Housing Group’s estimate of Lagos’ residential stock, which was around 1.49 million residential units in 2016, you begin to see the picture more clearly. According to Pison, the total number of formal houses in Lagos was One million, Four hundred and Ninety thousand houses, and when you reconcile this number, with the 4.69 million units that Lagos needs, it puts the housing deficit for Lagos at 3.2 million housing units.

For context, Lagos has not been able to meet up to 50% of her formal housing demand till date.

Some people will argue that Lagos’ population figure is not up to 23 million yet. If we decide to use the United Nations’ estimate of 17 million as of 2018, it brings Lagos’ housing deficit to approximately 2 million residential units. Whichever way you would like to look at these numbers, one fact is clear, Lagos has not been able to meet up to half of its residential demand. We are sure by now, you will be wondering, if this is true, then where are the remaining over 50% of Lagos’ population living? The short answer is informal settlements, but that is not the focus of this conversation. We are more concerned about what this massive deficit means for you? Whether you are a developer or working 9 to 5 in Lagos, these numbers impact you in one way or the other. These impacts are further discussed in the following paragraphs.

The shortage induced demand pressure led to the recent surge in prices and presents an opportunity for housing financiers and investors.

If you live in Lagos, one thing you cannot deny is the fact that rental rates in most locations across the State have more than doubled over the past 5 years. This was confirmed from our experience over the period, alongside our interaction with long standing agents in the market. We understand that no single factor is responsible for this price surge. Inflation, multiple naira devaluations and the increasing cost of construction input all have contributed a quota, but chief among them is excessive demand. Looking at the housing deficit from the perspective of an investor, Lagos presents a huge opportunity. The World Bank estimates that by 2030, Nigeria will emerge the 3rd most populous nation in the world after China and India. This will position Lagos as the 3rd largest city in the world. Historically, the combined effort of all existing players including the Lagos State Government and private developers, has done less than 50% of the job. This said, a strong prospect for increased private sector participation in tapping this opportunity still exists within the Lagos market, and we expect to see more private sector involvement in real estate development in the State over the next few years.

We would love to hear from you. Please send your comments and feedback to research@buyletlive.com or reach us through Buyletlive.com and we will be in touch.

First, take virtually EVERY data in Nigeria with a grain of salt (GIGO).

Nonetheless, a real housing “deficit” does NOT mean that everyone who desires housing cannot get it, but rather that people who can AFFORD housing cannot get such housing. For instance, if you cannot afford housing in Manhattan or Mayfair does not equate to a housing “deficit” in those locations. The factual reality of scores of empty houses in Lagos affirms that there is NO real housing deficit in Lagos, but rather a shortage of affordable housing. That’s a distinction with a difference.

PS: Also there is virtually NOWHERE in Nigeria that “a household size of 4.9 persons” is reflective of factual reality. That would imply that the Nigerian household average would be 2 parents + 2 kids + 1 extended family member or house help. That’s just fiction! In reality, the typical Nigerian household size is way more than that. GIGO

Housing will continue to be a problem until government is ready to address it in a wide scale and sustainable manner. The effect of local politics on urban governance cannot be overemphasized even as LASG looks to regulate real estate agents in the state.

Nevertheless, LASG does not recognize real estate agents as assets let alone understand their contributions to existing accommodation challenges in Lagos state.

Good luck

until the government addresses housing issues, it will continue to be a problem