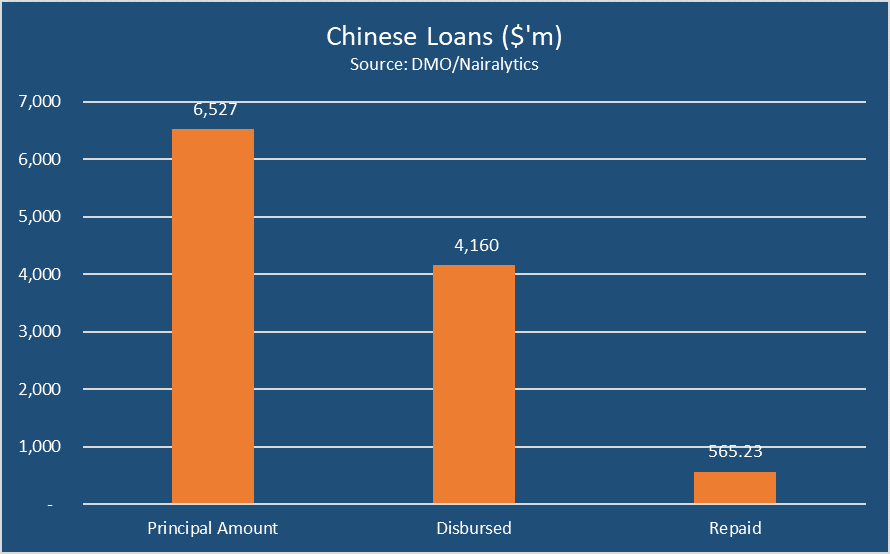

Latest data from the Debt Management Office reveal Nigeria’s debt to China is currently $4.1 billion as of September 2021. This balance is out of a total debt of $6.5 billion available for Nigeria to draw down.

Most of the debts are for a period of 20 years with a grace period to repay the principal of about 7 years. Only a $200 million debt had a tenor of 12 years with a grace period of 5 years. The loans are broken into dollar-based and Yuan based loans with $4 billion and another CNY480.

Nigeria’s debt to China has soared over the last decade as government diversifies its debt portfolio towards cheaper but controversial Chinese loans. Interest rates for the loans average 2.5% per annum. Back in June, the DMO reported that the total value of loans taken by Nigeria from China as at March 31, 2020, was $3.121 billion. This represents only about 3.94% of Nigeria’s total public debt of $79.303 as at March 31, 2020. Similarly, in terms of external sources of funds, loans from China accounted for 11.28% of the external debt stock of $27.67 at the same date.

Most of the loans were drawn down in the Goodluck Jonathan era with over $2.7 billion drawn out of a total principal available of $3.1 billion. The balance of $1.3 billion was drawn down between April 2016 and December 2019 as Nigeria stepped up borrowings.

Nigeria has also repaid $565.23 million in principal repayments and another $477.98 million in interest leaving an outstanding $3.5 billion to pay from what has been drawn so far.

What Chinese loans are used for?

According to the government, Chinese loans are project-tied loans. Some of these 11 projects as at March 31, 2020, are Nigerian Railway Modernization Project (Idu-Kaduna section), Abuja Light Rail Project, Nigerian Four Airport Terminals Expansion Project (Abuja, Kano, Lagos and Port Harcourt), Nigerian Railway Modernization Project (Lagos-Ibadan section), and Rehabilitation and Upgrading of Abuja-Keffi- Makurdi Road Project.