As more people adopt the online method of running their businesses, processing payments has become a challenge. As an e-commerce or online business owner, if you’ve successfully gotten a customer to the point where they are about to purchase a product on your website, integrating a safe and secure payment process where the customer can complete their online purchase is very vital. Without it, you won’t be able to securely charge your customers when they purchase items from your website.

Benefits of having a payment gateway

Integrating a Payment Application Programming Interface (API) is the safest and most professional way to deal with financial transactions online because it enables eCommerce sites to:

- Process credit cards

- Track orders

- Maintain customer lists

- Protect merchants from fraud and information breaches.

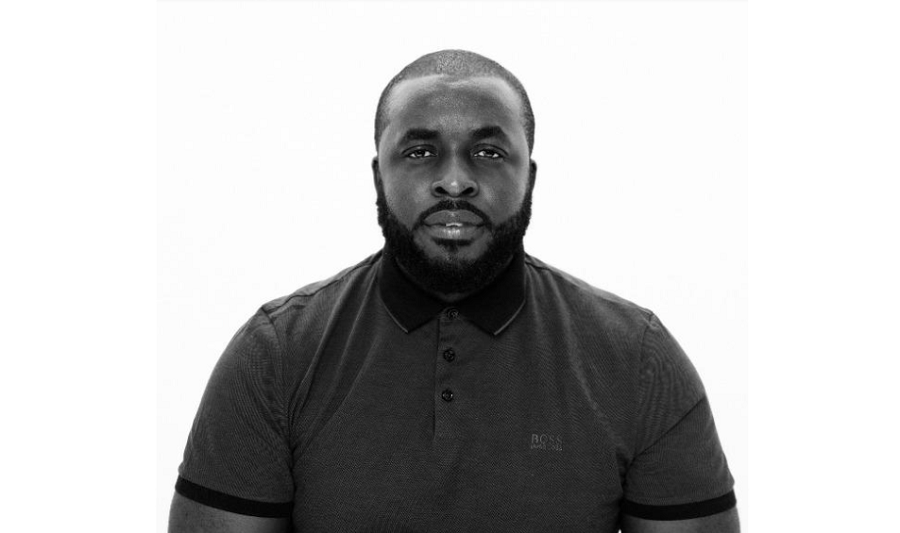

Many startups in Nigeria have come up with innovative ways to solve the problem of payments during checkouts. One such company is Seerbit. In an interview with Omoniyi Kolade, CEO of Seerbit, he explained how they are bridging the payment gaps in Africa.

What was the inspiration for founding SeerBit?

Over the last decade, Nigeria’s payments services witnessed an evolution spurred by growing commercial activities and the digital boom (increased internet usage and smartphone penetration). According to a 2021 report published by Data Reportal, about 50% of Nigeria’s population are using the internet and approximately 90% have access to mobile phones. This is an indication that half of Nigeria’s population have been digitally included, which is the backbone of online and real-time electronic payments systems. Other African countries are seeing the same shift too.

However, there is a huge gap in the market which doesn’t gain as much attention as it should. If 50% of Nigeria’s population have digital access, how are the majority of transactions in Nigeria and the rest of Africa still happening offline?

This is the gap SeerBit was created to solve. To create a truly digital ecosystem, we chose to create payment solutions that bridge the gap between online and offline usage, with innovations that defy boundaries. For example, the majority of Nigerians still transact in cash; how can we make sure that digital products are still available to this class of people, with convenient payment options?

This problem not only affects the cash-based customer but also the online merchants who could lose out on the billions of dollars happening in the offline market. SeerBit exists to plug these gaps, as our payments solutions are always geared towards creating opportunities for everyone to thrive.

In a nutshell, what does Seerbit do?

SeerBit is a pan-African enterprise payment platform developed for both online and offline businesses, banks and other marketplace companies. We enable fast, seamless, inclusive and secure payments for leading local and global companies present on the continent.

Apart from acting as a payment gateway, are there other services you offer?

SeerBit is more than just a payment gateway. We are in the business of using technology to address the fragmentations and frictions of payment on the continent. Our current service delivery is our payment gateway and we will soon release our payment solution targeted at offline merchants and customers.

What makes you different from Paystack and other leading payment gateways in Nigeria?

What sets us apart is our focus on the underserved and excluded segments of the market in Nigeria. We want to seamlessly connect the online and offline market in a way that removes friction for both consumers and merchants. As a consumer, SeerBit helps you to buy what you want and pay however you want, conveniently, and the merchant is empowered to reach a broader market because we have removed the barriers along the way.

You are operational in Nigeria, has government regulations affected SeerBit in any way, and how did you adjust to this?

One thing to note is that for every African country, there are unique sets of rules and regulations governing the sector of payments. There are 54 African countries, which means that there are 54 different rules for payments in Africa.

One of SeerBit’s strengths is our ability to scale and innovate within our current markets amidst these distinctive government regulations. We tailor/model our solution to work within the country’s license requirements whilst still solving real problems. Regulation is everything in this business and we make it our utmost priority to understand the local payment rules and regulations.

SeerBit has been in operation for over a year, how many merchants do you currently have?

Within 18 months of operation, SeerBit has over 1,000 merchants spread across 8 African countries (Nigeria, Ghana, Kenya, Senegal, Côte D’Ivoire, Uganda, Tanzania and Burkina Faso). SeerBit’s decision to focus first on East and West Africa is because we understand the fragmentation in these regions.

How successful has SeerBit been in other countries where it has a presence?

Success to SeerBit is measured by the following:

- Being able to scale/expand into new markets (in terms of merchants and office staff).

- Being able to understand the locality and customer type in each country to provide tailored solutions.

- Being able to innovate locally amidst the unique regulations in each country.

- Seeing the results of the SeerBit solution and how it impacts sales for merchants.

Looking at the aforementioned, SeerBit has enjoyed a good amount of success in the markets we operate in and are keen to add value to more merchants in our existing markets and also new markets as well.

Are there any future fundraising plans?

At this time, SeerBit’s focus is to continue to build out our solution and grow organically. Our priority is to create the utmost value in payments for Africa’s online and offline commercial space.

We are, however, open to the idea of fundraising and look forward to this happening somewhere in the near future.

.gif)

Impressive. Inspiring. and leading to the next generation of payment platforms. ?