The Nigerian hospitality sector has been one of the hardest-hit industries by the COVID-19 pandemic; travel restrictions and other reactive measures were adopted, which affected them negatively.

From earning revenue as high as $2 billion in 2018, the Nigerian tourism sector is seeing 5.7 million fewer travellers due to the pandemic, putting 149,400 jobs at risk and short-changing Nigeria’s economy by $1.1 billion.

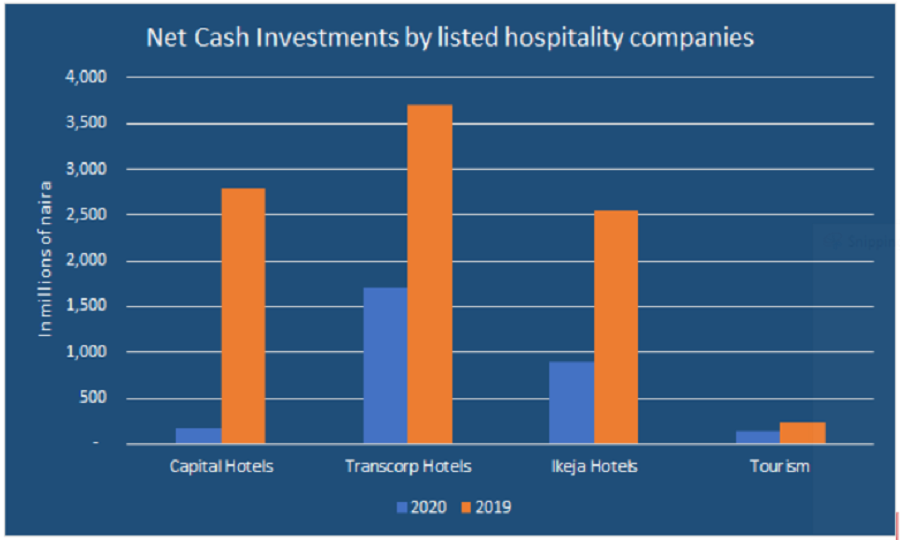

According to Nairalytics data, listed hospitality companies recorded a 56% drop in net cash investments going from N11.3 billion in 2019 to N4.9 billion in 2020. Two of the owners of Nigeria’s largest hotels Transcorp and Ikeja Hotels recorded the most drop in capital investments as depicted in the chart below.

READ: Hotels in Nigeria are on the verge of collapse

Data provided by Nairalytics

Data provided by Nairalytics

How this affects investment in hospitality

Reduced hotel occupancy rates

In its recent report on “What 2020 means for Hospitality and Housing,” W. Hospitality Group in Nigeria had said that the country’s hotel occupancy rates were largely driven by foreign tourism, with business tourism accounting for 70% of hotel demand in Lagos State alone.

Following the ban on domestic/international flights, the state’s hotel occupancy rates dropped from 70% in February 2020 to nearly 15% in April, before a post-lockdown recovery.

READ: COVID-19: Abuja Sheraton suffers 88% drop in revenues

Though the lockdown has been eased and the travel ban lifted, operators are not yet out of the woods. Prominent hotels like The Wheatbaker, Sheraton, The George, Southern Sun and Eko Hotels & Suites are not operating fully; some of them even spread their tentacles into new areas like food delivery, bakery and outdoor events, among others, as they explore safer means to stay afloat.

Reduced foreign investment

Travel and tourism are key to attracting investment and developing the economy. The tourism sector alone contributed 5.1% to the country’s GDP in 2019, unlike in 2020. With fewer travellers visiting the country for business and leisure, new and existing projects have noted less activity from the typical patrons.

Similarly, revenue losses from the industry plunged the country even lower into recession, rendering the industry unattractive for investments.

Estate Intel stated, “The dwindling patronage has indeed created existential issues for businesses as revealed by the Q2 and Q3 financials of some major listed hotels on the Nigerian Stock Exchange where revenue losses as high as 90% were recorded.”

This means that investors typically exited ‘risky’ assets to seek safer havens and hedge their exposures, and that might not change so quickly in 2021.

READ: Unmarked hotels and short-stay apartments report high occupancy rates during COVID-19

Decreased purchasing power to rent or acquire residential properties

With 149,400 jobs at risk, some businesses within the Nigerian travel industry have had to lay off their workers. The combined effect of job and income losses within and beyond the hospitality sector hampers the purchasing power for luxury properties including housing.

While new projects will “take much longer to be realized due to the lower demand and funding issues (shortages of debt and equity), the increases in costs due to the currency devaluation, as well as owners’ lack of willingness to continue existing projects will create shortages on the supply side of the industry,” Estate Intel added.

In summary, the loss of business from travel and tourism may have a silver lining which is reducing the dependency on foreign demand by exploiting local tourist participation and forging strategic alliances. In essence, they need to adapt their business model by looking inwardly and working locally.