The Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, has confirmed that the naira has depreciated at the official market to N410 against the dollar.

This, the Federal Government hopes to take a more dramatic step to increase exports in order to earn foreign exchange to boost dollar supply.

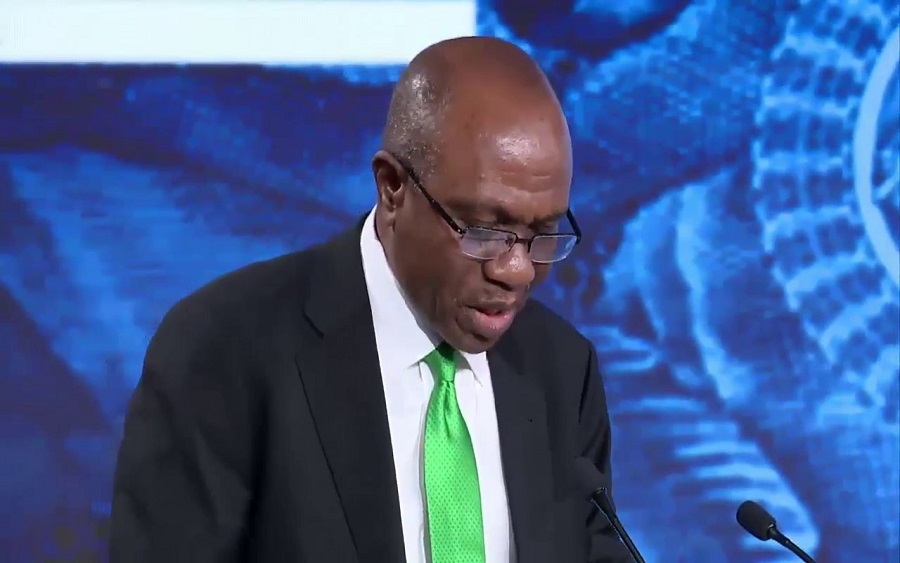

According to a report by Punch, this disclosure was made by Emefiele, while speaking at a special summit on the economy organized by Vanguard Newspaper in collaboration with the CBN and Chief Executive Officers of banks on Friday, February 26, 2021, in Lagos.

What the CBN Governor is saying

Emefiele said the drop in crude oil earnings and the associated reduction in foreign portfolio inflows significantly affected the supply of foreign exchange into Nigeria.

He said, “In order to adjust for the decrease in the supply of foreign exchange, the naira depreciated at the official window from N305/$ to N360/$ and now hovers around N410/$.’’

What the Vice President, Yemi Osibanjo, is saying

The Vice President, Prof. Yemi Osibanjo, who was part of the event said the Federal Government would address the shortage of foreign exchange.

He said, “We have accepted that we need to take a more dramatic step to boost exports in order to earn foreign exchange.’’

While pointing out that the government would combine limited resources to expand the supply base, Osibanjo said the Federal Government would ensure the expansion and promotion of export trading houses, ensure that companies in the special economic zones exported most of their productions, as well as expand the export grant scheme.

What you should know

- Nairametrics had reported about 2 weeks ago that the exchange rate between the naira and the dollar had been adjusted at the Investors and Exporters window where forex is traded officially as it had closed above N400/$1 since the second week in February.

- An exchange rate of N400 and above is perhaps a confirmation that official exchange rates across the multiple windows are crawling towards the target Non-Deliverable Forward (NDF) rates approved by the CBN.

- The CBN had maybe set the stage for the recent depreciation of the naira when on February 2nd it revised its one-year Non-Deliverable Forwards (NDF) for which it intends to settle foreign exchange futures contracts.

- In the contract terminating on February 24, 2021, the CBN priced the dollar at N412.14, compared to the average price of N395/$1 traded at the Investors and Exporters (I&E) window. Several days later, the exchange rate at the NAFEX market started depreciating initially touching N397/$1 before it crossed N400/$1 on the 9th of February 2021

Why is this rate applies to higher denomations only?

Now that naira is officially exchange for #410/$1 what will be the likely effect on the Nigeria economy, will this not also take the price of the dollar at parallel market to #500/1 or even beyond,fuel price increase etc

Expect naira to hit #610 to $1.

This current cbn governor is the worst cbn governor in the history of the country

I really like this idea