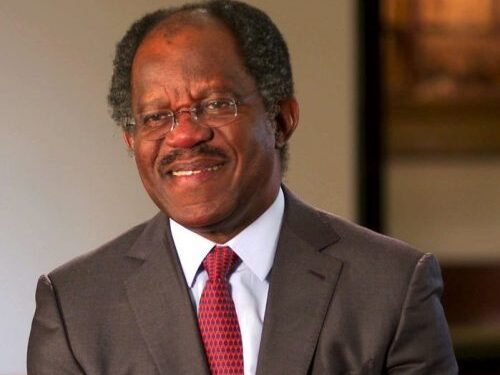

Nigerian-born billionaire investor and founder of Global Infrastructure Partners (GIP), Adebayo Ogunlesi, has hinted at possible investments in Nigeria’s ports and aviation sectors.

The 71-year-old, worth $2.6 billion, made this known while speaking after a meeting with President Bola Tinubu in Abuja.

Ogunlesi, who sits on the board of Goldman Sachs and whose GIP manages over $100 billion in global assets, revealed that his group is already exploring fresh investment opportunities in Nigeria.

While he declined to disclose specifics, he said, “We’re making investments in Nigeria. We explored additional opportunities. I’m not going to tell you what they are. Just wait. Watch this space.”

Sectors of interest

Despite not explicitly going into the details of the investment structure, Ogunlesi highlighted several sectors of interest.

“When you think about the sectors we invest in, energy, aviation, and infrastructure, Nigeria has huge potential. Nigeria is a huge gas province.”

“People describe me as the guy who bought Gatwick Airport. I didn’t personally buy Gatwick Airport, but the aviation sector is also an area of interest to us.”

- In energy, Ogunlesi noted that GIP is already building LNG plants in Texas and Australia, and described Nigeria as “a huge gas province” with untapped potential.

- On infrastructure, Ogunlesi admitted that his companies currently operate ports in Lomé and Cotonou but none in Nigeria.

“I asked Mr. President for forgiveness, and being the gentleman that he was, he forgave me. But he said, ‘You have to bring port investment to Nigeria.’ That’s another area we’re looking at.”

He further listed renewables as a priority sector with strong opportunities for expansion.

For Ogunlesi, the broader challenge now is for Nigeria to transition toward an export-led economy.

“Our President has done fundamental reform, and that reform has invited all these people you’re seeing. The next thing for us is to lead an export-led economy. The hope is on the rise,” he said.

What you should know

Adebayo Ogunlesi is one of the most influential figures in global finance. In 2006, Ogunlesi founded Global Infrastructure Partners (GIP) with support from Credit Suisse and General Electric.

Under his leadership, GIP acquired and managed critical infrastructure assets worldwide, including London’s Gatwick Airport and Edinburgh Airport, as well as major energy projects across the U.S., Europe, and Asia. By 2024, GIP had grown into a powerhouse with over $100 billion in assets under management. That same year, GIP was sold to BlackRock in a landmark $12.5 billion deal, further elevating Ogunlesi’s status in the investment world.

Beyond GIP, Ogunlesi sits on the boards of global institutions, including Goldman Sachs and OpenAI. His appointment to OpenAI’s board in 2025 boosted his visibility in the technology sector and reportedly added about $600 million to his net worth.

Forbes listed him among the 50 wealthiest Black Americans in 2024, with his fortune estimated at $1.7 billion at the time.