Crowdfunding in Nigeria has walked a long, uneven road, one that has seen bright promises, bitter losses, and the cautious hand of regulation.

For years, Nigerians desperate for alternative investments poured billions of naira into platforms dressed up as innovation but built on shaky foundations.

Many of these collapsed like the Ponzi schemes they were, leaving investors with nothing.

One of the most recent examples is Crypto Bridge Exchange, which promised Nigerians returns of up to 100% in just 30 days through digital asset trading. By April, withdrawals were restricted, and soon after, users discovered their balances had been wiped. The platform collapsed, leaving thousands unable to access their funds. Losses are estimated at about N1.3 trillion, though the exact recovery remains unclear.

The Securities and Exchange Commission (SEC), as far back as January 2021, issued rules establishing Nigeria’s first regulatory framework for crowdfunding. The rules defined who could raise funds, how much they could collect, and the safeguards required for investors. Platforms were expected to register as crowdfunding intermediaries, disclose their operations, and operate within set limits.

Today, only a few platforms carry the SEC’s approval to operate. They represent a narrow but significant slice of the financial system, one built not on promises of miracle profits, but on the steady rules of disclosure, limits, and accountability.

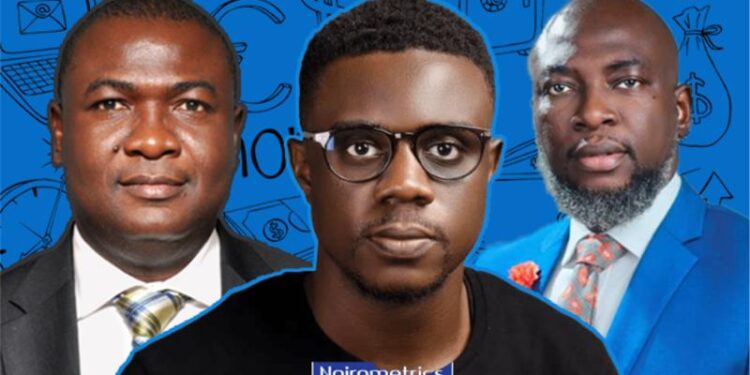

These are the firms carrying the weight of proving that crowdfunding in Nigeria can be trusted. And at the center of it all are the CEOs, men whose choices will determine how far this young industry can go.

Here are the owners of Nigeria’s SEC-approved crowdfunding platforms

Dr. Roland Igbinoba is a name synonymous with innovation in Nigeria’s real estate and proptech space. As the founder and CEO of Propcrowdy Ltd, he has positioned the company as a leading SEC-approved crowdfunding platform for property investment, providing Nigerians with an accessible and regulated avenue to grow their wealth through real estate.

The platform currently boasts over 20,000 active investors, highlighting its growing trust and reach across the country.

Beyond Propcrowdy, Dr. Igbinoba’s entrepreneurial footprint spans multiple ventures, including Pison Housing Company, PropTech54, and Niproptech, showcasing a career dedicated to transforming housing finance and property development across Africa.

With a professional journey rooted in finance and real estate, Dr. Igbinoba previously served as Managing Director and CEO of FHA Mortgage Bank Ltd, where he oversaw mortgage operations and contributed to sector growth. He also held the role of Deputy President at the Mortgage Bankers Association of Nigeria (MBAN), playing a critical part in shaping mortgage market development nationwide.

Earlier in his career, he led Pison Housing Company as President and CEO, steering projects that focused on financial inclusion and housing solutions for underserved populations.

Academically, Dr. Igbinoba combines rigorous expertise with practical experience. He earned a Doctorate in Business Administration with a focus on Economics and Finance from Cranfield School of Management, a Real Estate Development and Finance certification from Harvard University Graduate School of Design, and an MBA in Management from the Federal University of Technology, Owerri.

Dr. Igbinoba’s leadership continues to influence the evolution of Nigeria’s real estate sector, bridging the gap between traditional housing finance and innovative digital solutions for investors.

Any entity collecting money from d public on a particular returns monthly without following due process is ponzi and scam.

One entity called Ewealth Connect since December 2024 has been in this shabby business of collecting money from Nigerians with a promise of 100% interest in 21 days.

Thousands of Nigerian have sank billions of naira without hope of recovering their capital let alone the promised interest.

I’m calling on the authorities concerned to take necessary action, call Mrs. Ada (aka Ada Dollar ) the founder and pioneer of Ewealth Connect on 0706 095 2774 or join their telegram groups to see what they are up to. They have graduated to creating fake crypto token for d public to buy.

https://t.me/ChainMergeReality