Retirement is meant to be a season of rest, travel, and enjoying the fruits of decades of hard work, not a time spent anxiously checking whether your savings will stretch through the month or relying on your children.

The real joy of this phase lies in sustaining the lifestyle you built while working, free from the fear of financial shortcoming.

Yet, one silent thief threatens that comfort: inflation.

Even the most carefully planned nest egg can be eaten away over time.

In Nigeria, inflation has been stuck in double digits for years, currently at 22.22%, steadily draining purchasing power for both retirees and those nearing retirement.

Yes, we are in a period of disinflation, meaning price increases are slowing. But slowing increases are not the same as falling prices.

When the cost of basic goods and services has already climbed steeply in recent years, even slower inflation still strains living standards.

That’s why retirees and soon-to-be retirees need an investment plan that protects capital during turbulent times and grows it during calmer ones.

The golden rule is clear: your returns must outpace inflation, or you’re effectively losing money.

The second rule? Balance risk and reward. While high returns often come with high risks, a well-structured retirement portfolio leans on low-risk and risk-free assets, while still keeping enough growth-oriented investments to match or beat inflation.

So, where exactly should you put your money?

Let’s explore three approaches: Aggressive, Moderate, and Conservative — and see what might work for your retirement journey.

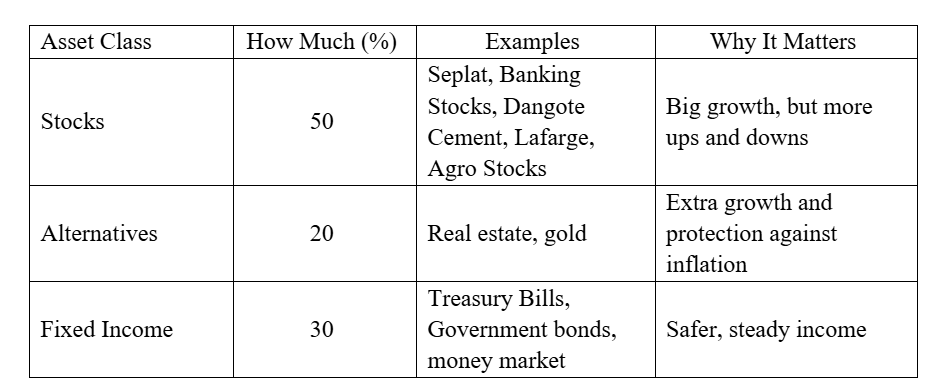

Aggressive strategy:

The aggressive investor isn’t chasing small wins they’re hunting for big, market-beating returns. The trade-off – Higher risk, higher volatility.

In this portfolio, equities take center stage, backed by selective high-yield instruments and a dash of real assets to balance the swings.

Investors should look beyond the share price and dividend returns and also consider stocks with high liquidity, high-float stocks like the banking stocks.

Every allocation is intentional: stocks for growth, alternatives for alpha, and fixed income only as a cash flow cushion.

With this mix of investments, you can expect your money to grow by around 40% each year. Of course, the value will go up and down that’s normal when chasing bigger returns. But when you weigh those ups and downs against the rewards, this portfolio is designed to give you a good balance between risk and reward.

Think of it like riding a roller coaster that’s thrilling but well-built there might be some bumps, but the ride is worth it!

Moderate strategy: Balanced growth with less risk

The moderate investor wants steady growth but prefers fewer surprises along the way. This portfolio reduces the weight on stocks and increases safer investments, helping smooth out the ride.

Equities still play a big role but share the spotlight with fixed income and alternatives. Investors should still pick stocks with good liquidity and strong fundamentals, but lean toward blue-chip names that are a bit less volatile.

Every allocation aims for steady growth while protecting your savings from big market swings.

With this mix, your money is expected to grow around 33% a year. It won’t jump as high as the aggressive portfolio, but the ups and downs are softer like a smoother ride that still gets you where you want to go.

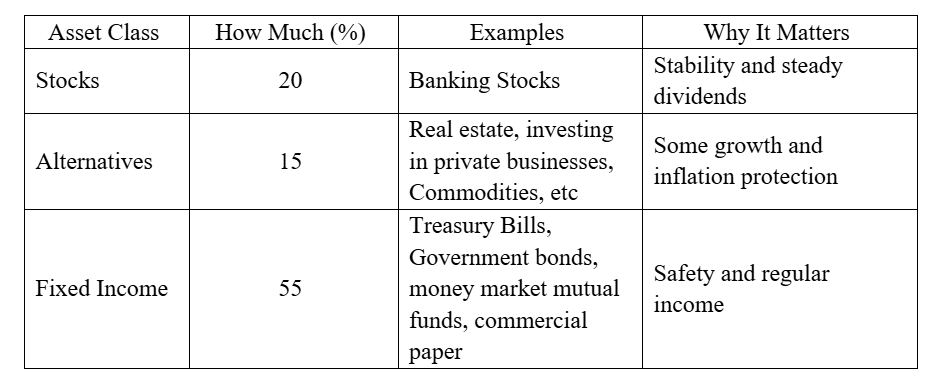

Conservative strategy: safety first, modest growth

The conservative investor prioritizes protecting their savings over chasing big returns. This portfolio is designed to keep your money safe, with the majority in low-risk assets like government bonds and cash.

Stocks are included but in smaller amounts, focused on steady dividend payers with strong liquidity to reduce risk. Alternatives provide a little boost but don’t add too much volatility.

The goal here is peace of mind and a reliable income stream with modest growth.

This portfolio aims for about 27% growth a year. But if you increase your take in Alternative assets, you might get more than the 27%.

The ride is much smoother here, with less chance of surprises like cruising steadily on a calm, scenic highway

Overall, whether you choose an aggressive, moderate, or conservative approach, the key is to build a portfolio that not only grows your money but also balances risk and reward in a way that suits your personal comfort level and financial goals.

An aggressive portfolio aims for high growth but comes with more ups and downs. A moderate portfolio offers a smoother ride with steady growth, while a conservative portfolio prioritizes safety and reliable income with modest growth potential.

No matter your choice, ensure your returns outpace inflation that’s the golden rule to keep your retirement savings intact and growing in real terms.

Final Takeaway

- Start by understanding your risk tolerance and retirement goals.

- Diversify your investments across assets

- Focus on assets with strong fundamentals, good liquidity, and inflation-beating returns.

- Review and adjust your portfolio regularly as you approach retirement to reflect changing needs and market conditions.

Can this apply to a Retired Civil Servants in Nigeria. Unless the officer has more personal savings before retirement.

You will need a steady cashflow to survive.

Investment in stock, treasury bills, real estate will depend on how much you have to invest. The type of final entitlement being received by Civil Servants in Nigeria is nothing to write home. A full Director getting less than N5m as Lump Sum and receiving a monthly pension of less than N120k in this economy cannot fit into this investment profile.

Engaging in small trade that can ensure constant cash inflow to support the meagre pension will help a great deal.