The Tertiary Education Trust Fund (TETFund) has received a record N1.6 trillion for interventions across Nigeria’s tertiary institutions, marking the highest allocation in the agency’s history.

The fund, derived from the 3% education tax on company profits as mandated by the TETFund Act, is being strategically deployed to address critical needs in education, healthcare training, energy infrastructure, and student support.

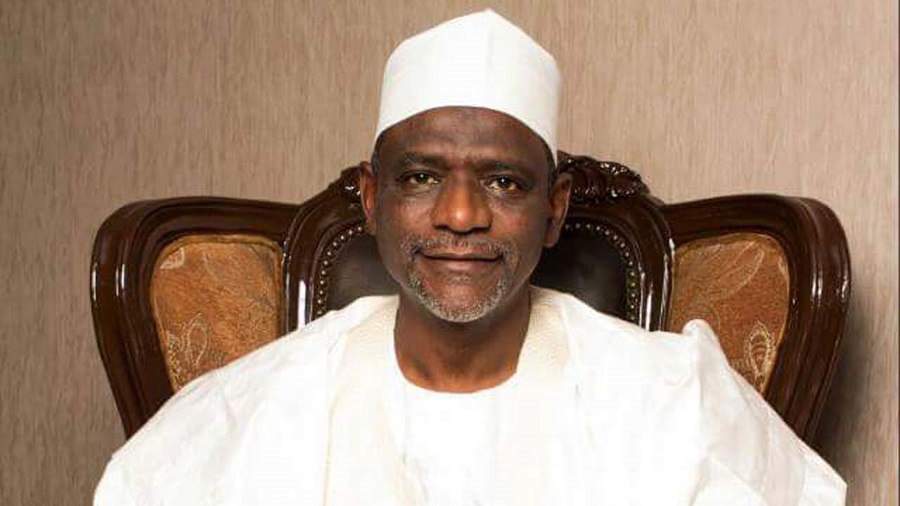

This was disclosed by Aminu Bello Masari, Chairman of TETFund’s Governing Board and former Governor of Katsina State, during a media briefing in Katsina on Sunday.

Masari provided a detailed breakdown of how the funds are being allocated to ensure transparency and impact.

“The interventions are demand-driven. Institutions write to us, and we approve projects for them based on their needs and available resources,” Masari explained.

Strategic Allocations Across States and Sectors

Of the total N1.6 trillion, N460 billion, representing 40% of the fund, has been earmarked for direct interventions across tertiary institutions nationwide. In each state, three institutions, a university, a polytechnic, and a college of education, have been selected to benefit from these allocations.

In addition, N225 billion has been released to the Nigerian Education Loan Fund (NELFUND) to support the Federal Government’s student loan scheme, aimed at expanding access to higher education for financially disadvantaged students.

To address energy challenges in tertiary institutions, N70 billion has been allocated for the development of solar and gas-powered generation facilities, helping campuses reduce reliance on unstable grid electricity and improve learning environments.

Masari also revealed that N25 billion has been set aside for campus security enhancements, including the installation of street lighting and other safety infrastructure to protect students and staff.

Boosting Medical Education and Healthcare Workforce

In response to Nigeria’s growing healthcare manpower crisis, TETFund has committed over N100 billion to strengthen medical sciences training across tertiary institutions. This initiative aligns with President Bola Tinubu’s directive to address the exodus of skilled medical professionals and rebuild capacity in the healthcare sector.

“The President is worried about this trend and its impact on the healthcare system,” Masari said.

“He wants measures in place to enable recovery through deliberate policies, such as this ongoing TETFund intervention.”

As part of this effort, three institutions in each geopolitical zone have received N4 billion each to expand infrastructure and training programs in medicine, nursing, pharmacy, laboratory science, and other critical fields. The goal, Masari emphasized, is to double the number of healthcare professionals in Nigeria and improve service delivery nationwide.

Accountability and Nationwide Impact

Masari assured Nigerians that TETFund maintains a robust monitoring and evaluation framework, supported by independent consultants, to ensure that all disbursed funds are used strictly for approved projects. He reiterated that the agency’s interventions are carried out annually at both state and zonal levels, ensuring equitable distribution and high-impact outcomes across the country.

“This will greatly improve healthcare delivery nationwide,” Masari stated.

With this historic allocation, TETFund is positioning itself as a key driver of national development, supporting education, healthcare, energy, and student empowerment in alignment with Nigeria’s broader socio-economic goals.

I am blessing Moses chiwendu from ebonyi State Nigeria live in Lagos Nigeria today happy new month 💯