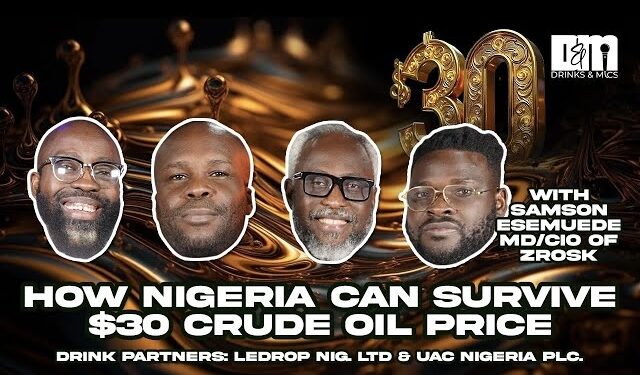

Ugodre is back! On the 18th episode of Drinks and Mics, the squad kicks off with laughs, gifts, and a classic Ugodre comeback after a brief hiatus. Joined by Arnold, Tunji, and special guest Samson Esemuede, the banter quickly gives way to the big question: Can Nigeria survive if oil drops to $30 per barrel?

With crude prices slipping below $60 and global demand showing signs of weakness, the team unpacks what this means for Nigeria’s economy. Arnold expects oil to remain soft, Samson explains how frontloaded imports distorted U.S. GDP, and Tunji argues the Tinubu-led administration must keep infrastructure spending going, regardless of shrinking oil revenue.

The conversation shifts to the Central Bank of Nigeria’s response to the changing macroeconomic landscape. Samson raises concerns about how long the apex bank can sustain exchange rate interventions without new dollar inflows. Tunji notes that while the CBN has taken bold steps on interest rates and FX reforms, it may need stronger fiscal backing if oil receipts continue to weaken. Ugodre points out that monetary policy alone won’t be enough to steady the naira in the long term.

That led to a sharp exchange on possible funding options. The panel weighs panda bonds and potential infrastructure-for-credit deals with China as alternatives. With infrastructure tied closely to the administration’s legacy, the team agrees that any slowdown in spending could threaten both growth and political capital.

Could Nigeria really withstand $30 oil?

Watch the full episode now on Nairametrics TV on YouTube.