Influencers and celebrities have been cautioned by the Securities and Exchange Commission (SEC) not to support or advertise unregistered financial products.

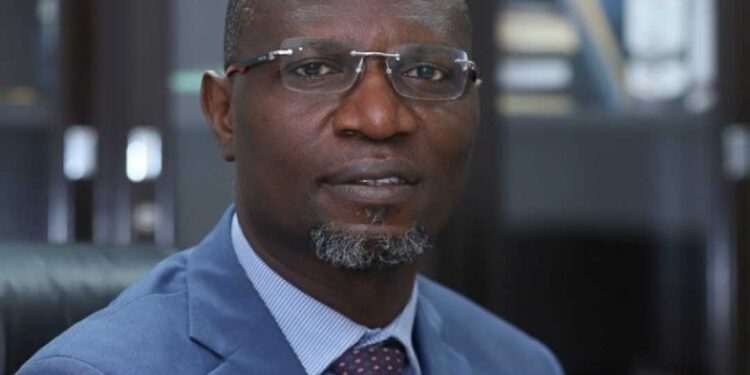

SEC Director-General (DG) Emomotimi Agama spoke out against influencers endorsing unregistered digital asset platforms and meme coins.

Agama cited the Investments and Securities Act 2025, which President Bola Tinubu recently signed.

The act outlined explicit guidelines for digital asset platforms, including registration requirements to foster openness and confidence.

He claims that this enables the SEC to act against illegal activities like unregistered exchanges, pump and dump tokens, and Ponzi schemes.

“We must exercise caution in our actions, even as celebrities,” he stated. Becoming influencers or launching memes that are detrimental to Nigerians will not be accepted.

The House of Representatives issued a warning to public figures, celebrities, and influencers about the dangers of endorsing unregistered investment schemes.

The House of Representatives spokesman emphasised that promoting unregistered investment schemes could result in liability against any of them found to be deficient under the new Investments and Securities Act (ISA).

The large number of these professionals is another cause for concern. The new policy requires Influencers to validate that their cryptocurrency clients possess an SEC license before advertising any relevant products, indicating that the services the Influencer provides come under control services. Every advertisement and marketing activity must be marked as sponsored content.

There are severe penalties for failure to comply, which could lead to a minimum N10 million fine, three years in prison, or both. In their promotions, influencers must also use plain language.

Using any form of vague language or overly optimistic phrases, such as “secure your future” or “double your earnings now,” is warned against by the SEC. No statement that would mislead or confuse prospective investors may be included in advertisements according to SEC principles.

Moreover, these advertisements are subject to pre-publication approval by the Commission. The Commission explained that this action was taken to tame heightened worries about financial influencers marketing unregulated digital asset investments.

An influencer is a person who, through social media recommendations or promotions, can sway others’ financial decisions due to their fame or cultural standing. By posting entertaining videos

or posts to their social media accounts, they can sway potential customers and encourage them to share them with prospective customers.

The practice of marketers funding celebrity endorsements is not new, but what is different is that these lighthearted and overly sentimental endorsements are being made in a highly regulated sector with strict guidelines regarding performance claims and potential conflicts of interest.

Financial product endorsements ought to be viewed with suspicion and given the same amount of thought and attention as any other significant business choice.

The following approach should be taken

Credentials Check: If the influencer says they have a financial certification or experience in the financial industry, find out if it is from an accredited organisation and whether they are currently in good standing with the regulator and if the product is SEC registered.

Advising someone when you don’t know enough about their risk tolerance, current financial status, familiarity with financial terms and products, or overall financial situation raises serious concerns.

Show Me the Data: Some influencers gain followers by consistently making “to the moon” promises about stock selections or investment strategies. They are probably too good to be true if they only highlight their incredible outcomes

Do Your Research: Before investing, conduct independent research rather than relying on an influencer. Seek financial/investment advice from a regulated investment bank/stock brokerage firm; taking advice from unlicensed financial advisors can be problematic, particularly if they are trying to con or defraud you.

Only Invest Money You Can Afford to Lose: Never pay with cash or take out a loan to finance an investment when investing in cryptocurrency assets or other high-risk investment goods or services. You won’t be able to get your money back if your investment doesn’t work out, or worse, you’ll be forced to pay off a debt for a useless asset.

Maintain Records: It’s critical to maintain detailed records of the people you are investing with, including their full legal name, affiliate organisation, and contact details, as well as the amount and dates of your investments. This information will be useful if you run into issues, so you can try to get your money back or file a complaint.