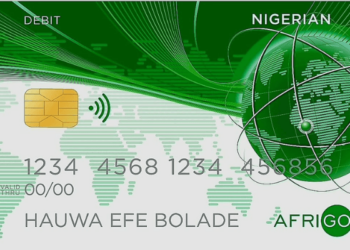

AfriGO and PalmPay have formed a strategic partnership to issue over 5 million AfriGO payment cards in Nigeria.

This collaboration aims to enhance financial inclusion, empower underserved communities, and strengthen Nigeria’s digital payment ecosystem.

“AfriGO and PalmPay have announced a strategic partnership. This collaboration aims to redefine the payment landscape by issuing over 5 million AfriGO cards to Nigerians. Through this initiative, AfriGO and PalmPay are set to empower underserved communities, drive financial inclusion, and strengthen Nigeria’s digital economy,” they said.

AfriGO is Nigeria’s national domestic card scheme, launched by the Central Bank of Nigeria (CBN) in partnership with the Nigeria Inter-Bank Settlement System (NIBSS) to strengthen the country’s digital payment system.

Unlike foreign card schemes, AfriGO is designed to be more affordable and accessible, with transactions settled entirely in naira, eliminating foreign exchange risks and lowering costs for both banks and users, as all transaction processing happens within Nigeria

Benefits for merchants and consumers

Chika Nwosu, Managing Director of PalmPay Nigeria stated that the partnership with AfriGO will provide secure, affordable, and locally tailored payment solutions to empower Nigerians and boost the digital economy.

“At PalmPay, we are committed to creating financial solutions that are not only innovative but also inclusive. Partnering with AfriGO allows us to deliver secure, cost-effective, and localized payment options that empower Nigerians and strengthen the digital economy. This is a milestone in our mission to redefine financial accessibility in Nigeria,” they said.

- AfriGO cards provide users with a convenient way to carry out various financial transactions, whether for in-store or online purchases, withdrawing cash from ATMs, transferring money, or making cashless payments through Agent POS terminals.

- Additionally, the AfriGO Instant Settlement service ensures that merchants and agents receive payments immediately after transactions, which enhances efficiency, improves their cash flow, and minimizes financial risks.

Ebehijie Momoh, Managing Director/CEO of Afrigopay Financial Services Limited (AFSL), emphasized that the partnership with PalmPay will enhance digital payment access and support Nigeria’s growing digital economy.

“We are excited to partner with PalmPay to revolutionize financial services and expand access to digital payments across Nigeria. Through this collaboration, AfriGO and PalmPay will provide enhanced access to digital payments—particularly in underserved areas—drive financial inclusion, and support the rapidly growing digital economy in Nigeria,” he said.

The card is built on EMVCo standards, ensuring secure transactions through tokenization and contactless payment features. PalmPay will integrate these capabilities into its digital ecosystem to offer a seamless and secure payment experience.

What you should know

Across the world, tap-to-pay transactions have become the norm, making payments faster and more seamless. In Nigeria, where cash and PIN-based transactions still dominate, the federal government, fintechs, see an opportunity to introduce a smoother digital payment experience.

AfriGO has also partnered with Moniepoint to roll out five million contactless payment cards and tap-to-pay solutions across Nigeria. The Nigerian government has partnered with Mastercard to drive financial inclusion by providing 1 million farmers across the continent with access to digital financial services and contactless payment solutions.