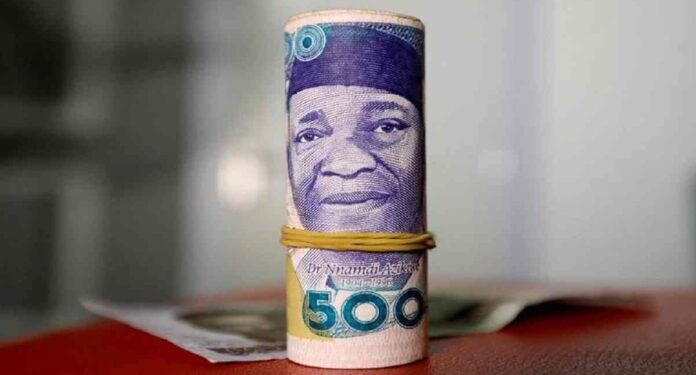

The Nigerian naira showed its biggest sign of stability in February, despite closing the month 1.6% weaker in the official market.

In contrast, the parallel market saw a sharp appreciation of 6%, indicating improving liquidity in the retail forex segment.

The official exchange rate on the Nigerian Foreign Exchange Market (NFEM) ended the month weaker, but analysts believe the overall trend suggests growing stability.

The naira has now recorded a 2.3% year-to-date depreciation, a far cry from the extreme volatility witnessed in previous months.

- Despite a $4 billion decline in Nigeria’s foreign exchange reserves, the exchange rate has remained largely stable, attributed to improved transparency in the Central Bank of Nigeria’s (CBN) forex policy and the new forex trading framework introduced late last year.

- Also, despite the Naira’s slight depreciation in the official market, there are signs of increased foreign investor confidence.

Sources have informed Nairametrics that foreign portfolio investors are showing growing interest in Nigeria’s fixed-income market, particularly in Treasury Bills and bonds.

- The return of foreign investors is seen as critical in maintaining stability, as their inflows provide much-needed forex liquidity.

Boost to forex stability – Another key factor supporting the naira is the recent increase in crude oil production.

- In January, Nigeria’s total crude production, including condensates, reached 1.7 million barrels per day (mbpd), up from 1.48 mbpd in December. Excluding condensates, production stood at 1.54 mbpd.

- Higher oil production has translated into stronger forex inflows for Nigeria, with crude oil prices averaging around $74 per barrel in recent months.

- This improvement in forex earnings has helped stabilize the naira despite external pressures.

BDC allocation – A major contributor to the naira’s performance, particularly in the parallel market, is the increased liquidity driven by Bureau De Change (BDC) allocations.

- Market sources indicate that the increased forex supply to BDCs has helped narrow the gap between the official and parallel market rates.

- In February, the parallel market exchange rate strengthened from N1,600/$1 to N1,500/$1, marking a 6.6% gain. This suggests that liquidity at the retail end of the market has improved significantly.

Nairametrics previously reported that the CBN’s decision to allow BDCs to access forex directly from authorized dealers was aimed at improving price discovery and reducing speculative activities in the forex market.

- The Central Bank extended the deadline for Bureau de Change (BDC) operators to access the Nigerian Foreign Exchange Market (NFEM) for weekly FX purchases till May 30, 2025.

- A circular in December 2024 granted temporary access to BDCs to purchase foreign exchange (FX) from Authorized Dealers with a weekly cap of $25,000.

See video below

Analysts caution against overvaluation

While the naira’s relative stability is encouraging, some analysts warn that a stronger naira without solid economic backing could lead to another sharp depreciation, similar to what happened in March 2024.

- At that time, the naira briefly surged to under N1,200/$1 before experiencing a significant reversal. Some estimates suggest that the naira’s Purchasing Power Parity (PPP) value is around N1,200/$1, meaning any artificial strengthening could be unsustainable in the long run.

- Analysts on Nairametrics’ Drinks & Mic Show also expressed concern that while the naira may continue to hold firm in 2025, its stability is still largely dependent on foreign portfolio inflows rather than strong economic fundamentals.

- They argue that Nigeria still needs consistent foreign investment inflows and broader economic reforms to maintain long-term currency strength.

CBN Maintains rates as inflation remains a concern

At its February Monetary Policy Committee (MPC) meeting, the CBN opted to keep interest rates and other monetary parameters unchanged despite new data indicating persistent inflationary pressures.

- The CBN has signaled caution, emphasizing that while the exchange rate is stabilizing, it also needs to ensure that inflation trends are under control.

- Recent data showed that inflation remains elevated, prompting the central bank to hold off on any aggressive policy moves for now.

- Meanwhile, yields on short-term securities such as Open Market Operations (OMO) and Treasury Bills have dropped below 19% in recent weeks, even as investor demand continues to drive oversubscriptions above 100%.

- “The Committee highlighted the benefits of the improvements in the external sector to exchange rate stability, including the convergence of rates between the Nigeria Foreign Exchange Market (NFEM) and the Bureau de Change (BDC), and urged the Bank not to relent in its effort to boost market liquidity.” CBN

A More Stable Naira?

While the naira’s official market depreciation of 1.6% in February suggests some weakness, its stability throughout the month—along with the sharp gains in the parallel market—indicates that Nigeria’s forex market is on a more balanced trajectory.

- The combination of increased forex supply, growing foreign investor interest, and improved monetary policy transparency has helped keep the exchange rate from experiencing sharp fluctuations.

- However, experts caution that sustaining this stability will require ongoing reforms, improved economic fundamentals, and continued forex inflows.

- For now, the naira’s performance in February has provided much-needed relief for businesses and consumers, marking a notable shift from the volatility of previous months.

- Whether this trend continues will depend on how well Nigeria manages its fiscal and monetary policies in the coming months.