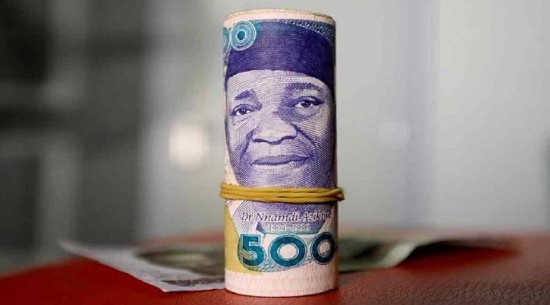

The Nigerian naira showed stability in the official market as demand for the greenback moderated during the second trading session of the week.

CBN data highlighted that the local currency settled at N1,534 against the dollar on Tuesday, marginally less than the N1,533.56 quoted at the Electronic Foreign Exchange Matching System (EFEMS) on Monday.

The naira demonstrates strength in the official market amid high inflation readings. NBS data showed the country’s inflation rate increased to 34.60 per cent in November 2024 from 33.88 per cent recorded in October.

The naira traded within the N1665/$ bandwidth, driven by importers, currency hedgers, and non-financial end-users, despite improved fundamentals in the official market.

The naira’s fundamentals brightened amid ongoing reforms by the CBN to improve the FX market’s efficiency and transparency in Nigeria.

Banks and authorized dealers can trade foreign exchange for spot transactions involving the greenback and naira using Bloomberg’s BMatch platform. EFEMS facilitates direct negotiations between market participants by offering buy/sell orders and real-time price publications.

Consequently, the IMF affirmed the naira’s stability, as noted in its October report, which also attributed recent interest rate increases and the Central Bank of Nigeria’s efforts to clear foreign exchange backlogs.

Dollar Index Reaches Three-Week High

The dollar held steady at three-week highs as traders braced for additional Federal Reserve interest rate cues.

Both the dollar index and dollar index futures remained near a three-week high reached earlier this week as they steadied during Asian trading.

- Interest rate cuts by the Fed of 25 basis points are generally anticipated. However, traders are betting on a potentially hawkish central bank outlook, particularly given recent data that indicates the labour market and inflation remain robust.

- The American central bank is anticipated to signal a slower pace of easing in 2025. A hold is projected in January, according to Goldman Sachs and other analysts.

- The Fed is expected to have sufficient headroom to lower rates more slowly amid better-than-expected retail sales data for November, which was released on Tuesday.

- Headline inflation readings and interest rates are also anticipated to be supported by expansionary and protectionist policies implemented by incoming President Donald Trump.

In addition to the Fed, central bank decisions in the Philippines, Thailand, Indonesia, and Japan are also due this week, offering additional clues about Asian monetary policy heading into 2025.

The Dollar’s Outlook: Bullish in the Mid-Term

BofA analysts predicted that the dollar would likely continue to outperform its G10 competitors in the coming months due to economic strength before declining in the second half of 2025, as investors reevaluate the election impact and the Fed implements additional rate cuts.

“As we await more clarity from Washington on several anticipated policy changes,” BofA analysts stated, “We are first looking for continued dollar support for the next several months on the back of ongoing economic outperformance in the world’s largest economy.”

The dollar’s trajectory will likely change in the second half of 2025, as the price boost in a pro-growth economy under a second Donald Trump administration fades. The analysts predicted that the USD’s strength would weaken at some point.