The Speaker of the House of Representatives, Rt. Hon. Abbas Tajudeen, has stated that taxes should be transparent and fair in Nigeria to avoid overburdening individuals and businesses.

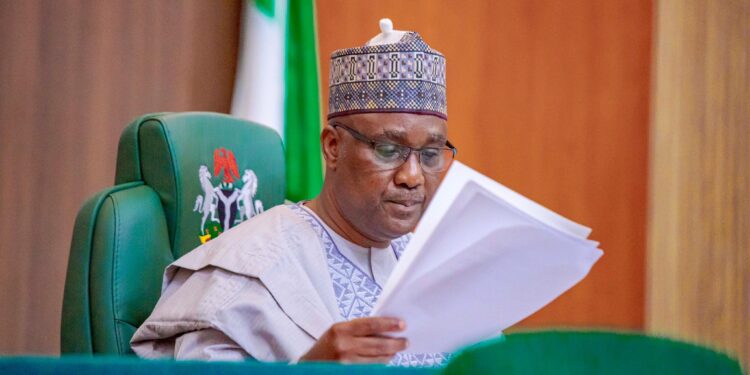

The Speaker made this known in Abuja on Monday at “The People’s House Interactive Session on Tax Reform Bills,” organized by the House, according to a statement signed by Musa Abdullahi Krishi, Special Adviser on Media and Publicity to the Speaker, House of Representatives.

The session drew relevant stakeholders from the public and private sectors, including the Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Mr. Taiwo Oyedele; the Chairman of the Federal Inland Revenue Service (FIRS), Mr. Zach Adedeji; the Director-General of the Budget Office, Mr. Tanimu Yakubu, and others.

Tax Reform Bills to Be Scrutinized for the Good of the Country

- At the session, Abbas assured stakeholders that the House would consider the Tax Reform Bills presented to the National Assembly by the Federal Government thoughtfully and in the best interest of Nigerians.

- Speaker Abbas stressed that the controversies and debates surrounding the bills are welcome, as they are healthy and necessary in a democracy.

- According to the statement, the Speaker noted that the Tax Reform Bills aim to diversify the country’s revenue base, promote equity, and foster an enabling environment for investment and innovation.

“However, as representatives of the people, we must approach these reforms thoughtfully, understanding their potential implications for every segment of society.

“Taxes should be fair, transparent, and justifiable, balancing the need for public revenue with the burdens they impose on individuals and businesses,” the Speaker added.

- Abbas said that lawmakers and other stakeholders would thoroughly examine the bills to ensure nothing in them conflicts with the 1999 Constitution (as amended) and the interests of Nigerians.

The Speaker stated: “Let me be clear: the House has not yet taken a definitive position on these bills. Our role is to scrutinize them thoroughly, ensuring they align with the best interests of our constituents and the nation at large. We owe this duty to Nigerians.

“Importantly, this session will help us identify areas needing amendment, clarification, or improvement and consider the compatibility of these bills with the 1999 Constitution (as amended) and other extant laws.”

- Speaker Abbas lamented that Nigeria, despite being Africa’s largest economy, struggles with a tax-to-GDP ratio of just 6 per cent—far below the global average and the World Bank’s minimum benchmark of 15 per cent for sustainable development.

- The Speaker stated that since taxes are the bedrock of public revenue in modern societies, the country must address this issue to reduce reliance on debt financing while ensuring fiscal stability and a secure future for Nigeria.

- Commenting on the four tax reform bills, the chairman of the presidential committee, Mr. Oyedele, was quoted as saying that there was nothing to fear in the proposals, as they are in the best interest of Nigeria, especially for the states and local governments.

Backstory

Nairametrics previously reported that President Bola Tinubu had rejected the National Economic Council’s (NEC) proposal to withdraw the tax reform bill, insisting that the council follow the “legislative process.”

In a statement, Tinubu’s spokesperson, Bayo Onanuga, said the president emphasized that any input from the council could be incorporated during the public hearing.

“President Tinubu commends the National Economic Council members, especially Vice President Kashim Shettima and the 36 State Governors, for their advice.

“He believes that the legislative process, which has already begun, provides an opportunity for inputs and necessary changes without withdrawing the bills from the National Assembly.”

- Nairametrics previously reported that the National Economic Council (NEC), which includes the 36 state governors and is chaired by Vice President Kashim Shettima, had recommended the withdrawal of the Tax Reform Bill currently before the National Assembly.

- The council’s suggestion was in response to a presentation by Mr. Taiwo Oyedele, Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, who emphasized the need for broader consultation with stakeholders to ensure alignment on the substantial impacts of the proposed tax reforms.

- The Vice President noted that the tax reforms introduced under President Bola Ahmed Tinubu’s Renewed Hope Administration aim to broaden the country’s revenue base, enhance economic stability, and lessen dependency on specific sectors.

- He acknowledged that these reforms present an opportunity to address stakeholders’ concerns, particularly regarding VAT reform and its effect on sub-national revenues.

Governors of the 19 Northern states, along with traditional rulers and stakeholders from the region, expressed opposition to the bill, particularly concerning the draft on the derivation-based model for Value Added Tax (VAT) distribution among the country’s federating units.