Nigerians abroad represent a significant portion of the African diaspora, contributing billions of dollars in remittances to Sub-Saharan Africa.

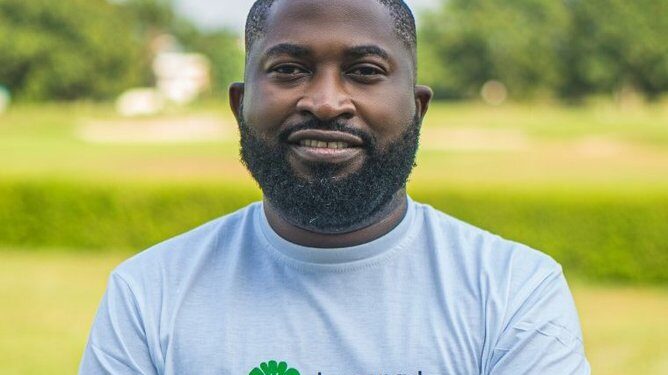

This observation comes from Ridwan Olalere, CEO of Lemfi, an international money transfer company founded in Nigeria.

His remarks align with a recent World Bank report that highlights Nigeria as a leading recipient of diaspora remittances in Sub-Saharan Africa, accounting for approximately 35% of the region’s total inflows in 2023.

Lemfi, which operates remittances for Nigerians, Ghanaians, Kenyans, and Ugandans across North America and Europe, noted Nigeria as the largest remittance segment in Sub-Saharan Africa. Nigerians send funds frequently, “averaging four transactions per month with typical amounts around $150.”

He also explained why Nigerians remit money from abroad referencing his company’s internal data.

Why Nigerians remit money from abroad

According to Ridwan Olalere, there are three core reasons Nigerians remit money from abroad. He highlighted these reasons at a meeting held alongside the IMF discussions in Washington, D.C., attended by representatives from the Central Bank of Nigeria, diaspora representatives, bank executives, and CEOs of International Money Transfer Operators (IMTOs).

According to him, three main drivers fuel this high remittance activity:

- Family Support: The primary motivation is to support family members back home.

- Cultural Commerce: A surprising trend has emerged in the UK, where Nigerians prefer to purchase items like wedding attire from Nigerian tailors known for high-quality fabrics, demonstrating a commitment to supporting local commerce despite living abroad.

- Investment and Business Ventures: Nigerians also remit money to fund investments such as mortgages, hotel operations, and other businesses back home.

What he said

“We’ve identified three main reasons Nigerians remit money. The first is family support. The second is commerce, particularly for unique purchases like wedding dresses, where Nigerians in the UK prefer to buy from Nigerian tailors because of the high-quality fabrics used. The third reason is for investments, such as mortgages, hotel operations, and other business ventures back home.”

These insights underline the unique relationship between the Nigerian diaspora and their home economy, fostering cross-border commerce and long-term investment.

What to know

Already, the World Bank report buttresses Raymond’s point as Nigeria attracted around $19.5 billion in diaspora inflows last year, making it the highest in the region.

- While Nigeria’s remittance inflows saw a slight dip of 2.9% from the previous year, this remains a significant sum, especially when compared to neighboring countries. Ghana and Kenya, also major remittance destinations in the region, received $4.6 billion and $4.2 billion, respectively.

- The World Bank report further underscores the vital role remittances play in many Sub-Saharan African economies. In nations such as Gambia, Lesotho, Comoros, Liberia, and Cabo Verde, remittance inflows constitute nearly one-fifth of their Gross Domestic Product (GDP), underscoring the reliance on diaspora inflows for economic stability and growth.

- Despite Nigeria’s leading position within the region, its $19.5 billion in remittance inflows is modest compared to global giants like India, which received approximately $119 billion in the same period.

- Already, the CBN Govenor, Yemi Cardoso stated that although naira had lost approximately 75% of its value since Tinubu’s inauguration, while fuel prices have increased fivefold.

Despite these difficulties, remittance flows have surged from $250 million per month earlier this year to $600 million in September, with authorities now aiming to achieve the ambitious $1 billion target.