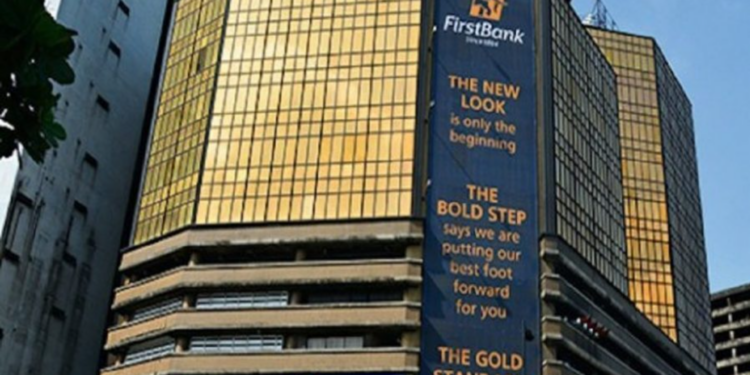

FBN Holdings Plc has announced a revision to its proposed Rights Issue, submitting a new application to the Nigerian Exchange Limited (NGX) for approval.

The updated proposal seeks to issue 5,982,548,799 ordinary shares of 50 kobo each at N25 per share, replacing the previous offer of 8,973,823,198 ordinary shares at N15.50 per share.

The new Rights Issue is structured on the basis of 1 new ordinary share for every 6 ordinary shares held, with a qualification date of October 18, 2024.

This comes after the original offer was suspended, reportedly following a court injunction sought by an aggrieved shareholder. Despite this legal roadblock, FBN Holdings appears to have received the green light to proceed with its strategic plans.

AGM to decide capital raise of N350 billion

The company’s Annual General Meeting (AGM), set for November 14, 2024, will see the proposed Rights Issue as a key agenda item, as indicated in the AGM notice, further solidifying the group’s capital-raising efforts.

- At the forthcoming 12th AGM, FBN Holdings will also seek shareholders’ approval for a N350 billion capital raise, as detailed in the notice.

- This will give the company the flexibility to pursue its financial goals through various capital market transactions, including rights issues, public offerings, or private placements.

- The capital raise is expected to strengthen FBN Holdings’ financial position and enable the group to fund strategic growth initiatives across its business units.

FBN Holdings’ capital raise journey

The revised Rights Issue is part of FBN Holdings’ long-running efforts to shore up its capital base and position itself for long-term growth.

As Nairametrics reported in August 2023, FBN Holdings had initially proposed a N150 billion capital raise to improve its balance sheet. Shareholders approved the capital raise in August 2023 alongside the appointment of Femi Otedola as a director, cementing a new era of leadership at the institution.

However, the company later expanded its ambitions, aiming for a N300 billion capital raise by early 2024. This plan was halted in April 2024, when the group cancelled its Extraordinary General Meeting following a court injunction filed by an aggrieved shareholder, which delayed the capital-raising process.

Now, with the AGM set for November 14, 2024, it appears FBN Holdings is ready to move forward, using the AGM as a platform to secure approvals for both the revised Rights Issue and a larger N350 billion capital raise.

According to the notice, the meeting will also discuss the election of new directors, including the formal ratification of Adebowale Oyedeji as Group Managing Director, effective November 13, 2024. Nairametrics earlier reported that Mr. Oyedeji was announced as the new Group Managing Director of the HoldCo taking over from Nnamdi Okonkwo.

What’s next?

- Pending approval by the NGX and shareholders at the AGM, the revised Rights Issue offers shareholders the opportunity to increase their stake at a premium price of N25 per share, compared to the earlier N15.50 per share.

- This move reflects FBN Holdings’ recalibrated strategy as it navigates both internal restructuring and external market pressures.

- Investors will be watching closely to see how this capital raise impacts the group’s financial standing and its ability to execute its long-term growth objectives.