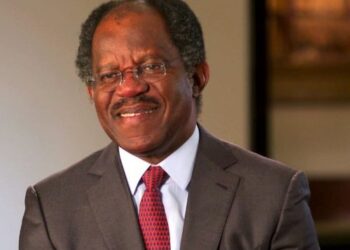

The CEO of the world’s largest Asset management firm Blackrock has recently declared Bitcoin an asset class putting an end to an age-long debate.

Mr. Fink believes Bitcoin is a legitimate investment vehicle and is an alternative to commodities like gold.

“We believe Bitcoin is an asset class in itself, “ said Larry Fink, the CEO of the world’s largest Asset manager.

Mr Fink made the statement while highlighting his firm’s ongoing innovation around Bitcoin during the Q3 2024 earnings call.

Fink in his assessment of Bitcoin downplayed regulatory changes arguing that broader acceptance and liquidity will drive Market Expansion.

In Broader terms, Fink highlighted BlackRock’s focus on improving market access through exchange-traded funds (ETFs). Blackrock launched an ETF product for Bitcoin and Ethereum both known as I Shares Bitcoin Fund and Ishares Ethereum Fund.

Fink revealed that Ishares Ethereum attracted over $1 billion in trading within its first two months of trading following the previous launch of the Ishares Bitcoin fund which has grown to $23 billion within the first nine months.

Fink revealed that both ETF products align with Blackrock’s mission to make investing easy and accessible to all.

“ We will continue to pioneer new products to make investing easier and affordable”

On Regulations

Larry Fink during the earnings call was quizzed on the effect of a new political administration that might be crypto-friendly. Analyst Ben Budish asked about the impact of a crypto-friendly administration in Washington on Blackrocks goals.

Larry Fink however played down the effect of Political changes and regulations on the crypto industry. He opined that the market growth of crypto assets will be driven by its broader acceptance of these assets rather than by regulations.

Larry Fink discussed further the factors that would influence the growth of digital assets. He stressed the importance of transparency, Liquidity, and Analytics in the growth of the crypto market. He highlighted the evolution of other financial markets as a historical basis, saying:

I truly don’t believe it’s a function of regulation — of more regulation, less regulation. I think it’s a function of liquidity, transparency … no different than years ago when we started the mortgage market, years ago when the high-yield market occurred.

He suggested that the digital asset market would mirror the expansion of these others markets as better analytics and data emerged.

“And I truly believe we will see a broadening of the market of these digital assets,” Fink stated.

What to Know

Larry Fink runs the world’s largest Asset Management with a majority stake in some of the biggest companies and brands in the world. The movement of traditional financial institutions like Blackrock into Crypto helped legitimize its acceptance as an alternative means of storing value.

Blackrocks two ETF products Bitcoin and Ethereum have pulled in Billions of Dollars from institutional investors.