The National Secretary of the Independent Petroleum Marketers Association of Nigeria (IPMAN), James Tor, has said petrol prices may drop after the federal government allowed marketers to buy directly from Dangote refinery and import from other sources.

Tor made this statement in an interview while speaking on the recent deregulation effort by the federal government to allow marketers to directly negotiate petrol prices from Dangote Refinery.

He said this move would end the Nigerian National Petroleum Corporation (NNPC) Limited’s monopoly as the sole purchaser of petrol products in the country.

He also mentioned that the federal government has not only approved direct purchases from Dangote but also allowed imports from other sources.

“I can say yes (that petrol price will decline) because there will be numerous places to get the product. When people selling the product are many, definitely they will come down with the price.

“And we that are selling it, we go for the person that is selling less, so there must be a decline. Presently, where NNPC is, the monopoly of handling everything, that is where is problem is. If they allow us to get it from Dangote refinery, after my president’s speech, we had a meeting and it was agreed that they will now allow marketers to get their products directly from Dangote refinery. And not even stopping on that, they have now agreed that they will give us license to import.

“By so doing, we believe and are very confident, because we have partners in the country and outside the country that we can partner with. And we have the products at affordable prices. After all, Nigerians are our people,” Tor said.

Backstory

Nairametrics previously reported that the federal government has given marketers the license to buy petroleum products directly from Dangote refinery following NNPC’s move to quit as middleman between the two parties.

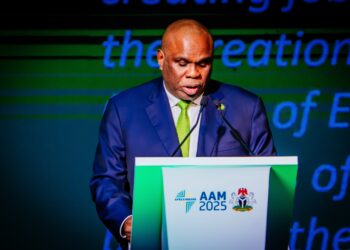

The Minister of Finance, Wale Edun, said the direct purchasing mechanism allows marketers to negotiate commercial terms directly with the refineries, fostering a more competitive market environment and enabling a smoother supply chain for petroleum products.

“New Direct Purchase Model: The most significant change under the new regime is that petroleum product marketers can now purchase PMS directly from local refineries. This marks a departure from the previous arrangement where the Nigerian National Petroleum Corporation (NNPCL) served as the sole purchaser and distributor of PMS from the refineries,” he said.

What you should know

The shift of NNPCL from being the sole buyer of petroleum products from the Dangote Refinery to allowing marketers to purchase directly marks a major step by the Federal Government towards full deregulation of the oil industry.

- In September, NNPCL revealed it was buying petrol from the Dangote Refinery at N898.78 per liter and selling it to marketers at N765.99 per liter, shouldering a subsidy of about N133 per liter.

- However, the company noted that this model was unsustainable.

- At the onset of petrol production from the Dangote Refinery, NNPCL initially became the sole off-taker, a situation that has since changed. Earlier this week, NNPCL increased petrol prices across its retail stations to over N1,000 per liter.

Last month, prices rose from N617 to above N900 per liter, with some states seeing prices surpassing N1,000 per liter. Last week, NNPCL again raised prices, with costs hitting approximately N998 in Lagos and N1,030 in Abuja.