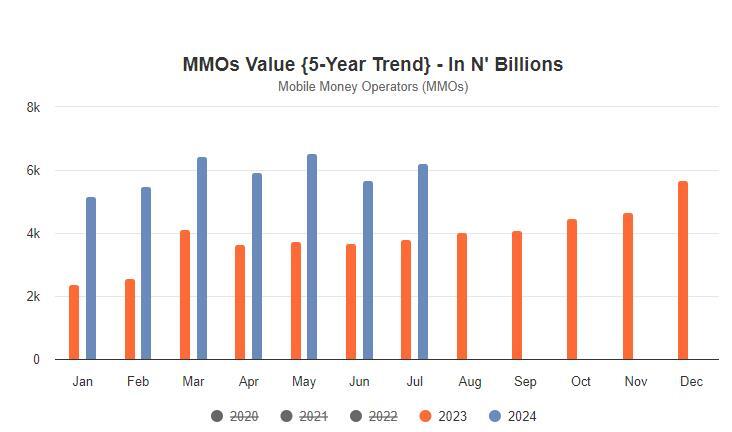

Data released by the Nigeria Inter-Bank Settlement Systems (NIBSS) has revealed that licensed mobile money operators including Palmpay, OPay, and 15 others processed transactions valued at N41.5 trillion between January and July this year.

This represents a 74% increase in transactions across the mobile money platforms when compared with the N23.9 trillion recorded in the same period last year.

In the full year 2023, all the mobile money operators processed transactions valued at N46.6 trillion, which came as the country’s highest annual mobile money transactions.

With N41.5 trillion already recorded in seven months, the mobile money operators are poised to break another record in terms of transaction value this year.

The mobile money operators

Nairametrics recently reported that there are currently 17 companies licensed by the Central Bank of Nigeria as Mobile Money Operators. While the mobile money operators could also be referred to as fintechs, there are over 200 fintechs in Nigeria but only 17 are licensed as mobile money service providers.

- For clarity, mobile money involves the use of mobile phones for the initiation, authorization, and confirmation of the transfer of a value out of a current/checking, savings, or stored value account.

- Meanwhile, the growth in transactions was recorded despite a one-month setback for some of the leading mobile money operators, who were momentarily stopped from onboarding new customers by the Central Bank of Nigeria (CBN).

- The CBN had recently directed OPay, Palmpay, Paga, and other fintechs not in the mobile money space including Moniepoint and Kuda Bank, to stop onboarding new customers over the suspicion that their platforms are being used by criminal elements to maneuver foreign exchange through crypto trading. The suspension was lifted after about a month.

What you should know

The surge in mobile money transactions is a reflection of the general upswing in e-payment in Nigeria in the first seven months of this year. According to NIBSS data, transactions across all electronic channels in the country from January to July hit N566.3 trillion.

The seven-month figure is already close to the N600 trillion recorded in the full year 2023 with five months of records to add for this year.

- Industry analysts believe that the surge in e-payment transactions can be linked to the recent cash crunch experience and the cashless policy of the Central Bank of Nigeria (CBN), which limited the amount of cash that can be withdrawn daily.

- According to the revised cashless policy, which came into effect on January 9, 2023, cash withdrawal by an individual is limited to N500,000 a week, while corporate organizations have N5 million withdrawal limit within the same period.