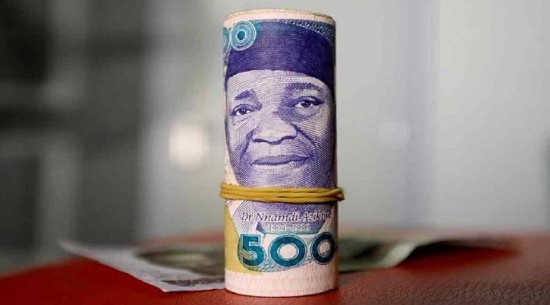

The Nigerian naira took advantage of weak U.S. dollar index readings in the official market and a surprise interest rate hike by the CBN amid ongoing dynamics in Nigeria’s fragile FX market.

The naira rose to trade at N1,576/$1 on Thursday at the official window after plunging to weekly lows. According to information from the Nigerian Autonomous Foreign Exchange Market (NAFEM), this amount was N91 less than the N1,667/$1 exchanged at the official window the day before.

However, the local currency lost momentum in the black market, trading at N1,700/$1 in most major Nigerian cities.

The naira’s parabolic nature reflects investors’ withdrawal amid profit-taking in the fixed-income space as they await proof that the federal government will implement the bold fiscal reforms needed to increase tax collection and oil production.

The naira’s boost came as the CBN increased interest rates on Tuesday by 50 basis points to 27.25% in its fight against inflation, which is nearing three decades high. Price activity suggests that naira short sellers are losing control of the N1,600 support line. This price level will likely be subject to further testing as demand for foreign cash rises, mainly for international tuition, vacations, and fuel imports.

The Central Bank of Nigeria has frequently had to step in and sell dollars to the nation’s registered foreign exchange dealers to achieve price stability, as the country’s FX supply side remains problematic, thus weakening the naira. The most populous African nation’s economy relies solely on crude oil exports for FX earnings, which have remained lukewarm amid oil theft and underinvestment in the oil sector.

Weak U.S. Dollar Index Readings

The U.S. dollar fell against major currencies on Thursday following the Federal Reserve’s dovish turn. However, market patterns suggest that a period of consolidation rather than further severe declines is more likely in the near term. In a study dated September 26, economists at Capital Economics noted that the dollar is nearing the bottom of its post-2022 range.

They stated, “We still believe that the U.S. dollar will weaken further in 2025 due to the ongoing decline in short-term interest rates and elevated risk sentiment.” Global markets remain risk-averse on Friday due to a plethora of Chinese stimulus measures. Effective Friday, the People’s Bank of China reduced the reserve requirement ratio (RRR) by 50 basis points (bps). The Chinese central bank also lowered the seven-day repo rate from 1.7% to 1.5%.

Mixed U.S. data on durable goods orders and jobless claims did not encourage buyers of the U.S. dollar on Thursday, resulting in gains for European and Wall Street stocks on the back of rate cuts, further hurting the value of the U.S. dollar. Fed Chair Jerome Powell was among the Fed policymakers who made scheduled appearances on Thursday; however, only two of them discussed monetary policy. While Governor Michelle Bowman maintained her aggressive stance, Fed Governor Cook supported the September 50 basis point rate drop.

According to the CME Group’s Fed Watch Tool, markets are currently pricing in a 50% likelihood of a 50 basis point (bps) rate decrease by the Fed in November, down from over 60% anticipated just a day earlier. The next U.S. Core Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation measure, could confirm predictions of a significant rate drop, which would determine the direction of the U.S. dollar’s next move. Furthermore, quarter-end flows may impact and agitate markets.