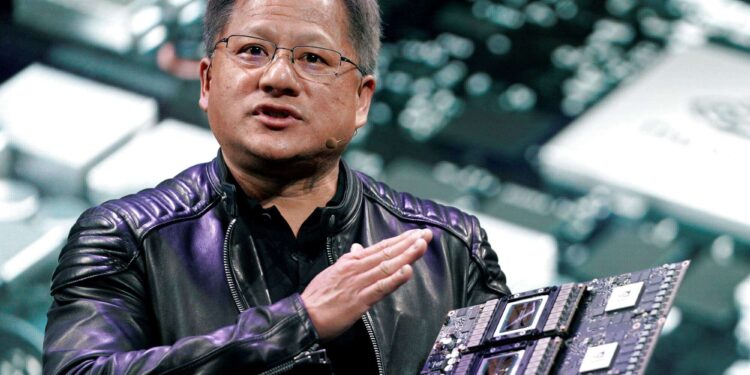

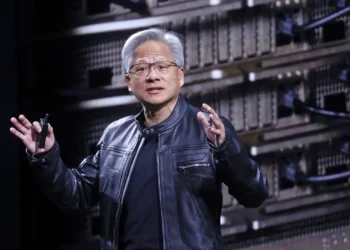

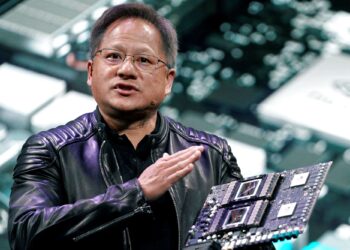

Tech billionaire Jensen Huang, the CEO and co-founder of Nvidia Corp., experienced one of the most significant financial setbacks of his career as his net worth plummeted by $10 billion on Tuesday.

The sharp decline in his wealth follows a steep drop in Nvidia’s stock price, driven by a broader sell-off in chip stocks and heightened concerns over an escalating antitrust investigation by the U.S. Department of Justice.

Huang’s net worth fell to approximately $94.9 billion, marking the largest single-day loss for the tech magnate since the Bloomberg Billionaires Index began monitoring his fortune in 2016.

The dramatic drop was largely triggered by a 9.5% decline in Nvidia’s share price, a response to both the Justice Department’s intensifying scrutiny and market reactions to Nvidia’s recent financial performance.

The Justice Department has issued subpoenas to Nvidia and other unnamed technology companies as part of a probe led by its San Francisco office.

The investigation reportedly focuses on potential anticompetitive practices, with regulators scrutinizing whether Nvidia has made it difficult for customers to switch to alternative chip suppliers or has penalized those who fail to purchase Nvidia’s artificial intelligence chips exclusively, Bloomberg stated.

A key area of interest in the investigation is Nvidia’s recent $700 million acquisition of RunAI, a firm specializing in AI management. Regulators are reportedly concerned that this deal could further entrench Nvidia’s dominance in the market, making it harder for customers to find alternatives to the company’s chips. This concern echoes sentiments previously raised within the chipmaking industry, as reported by The New York Times.

What to know

Nvidia’s shares closed down 9.5% on Tuesday at $108 per share, extending the losses by over 1.5% in after-hours trading.

The stock has been on a downward trajectory since the company reported record earnings last week that, despite setting new benchmarks, fell short of the sky-high expectations of investors.

Over the past five days, Nvidia’s shares have declined nearly 15%, erasing a portion of the substantial gains the stock had accumulated earlier in the year. Despite the recent downturn, Nvidia’s stock remains significantly higher compared to its January opening price of $48.17 per share.

Huang, who holds roughly 3% of Nvidia’s shares, has been a pivotal figure in the company’s rise to prominence. Born in Taiwan and later moving to Thailand, Huang was sent to the United States as a child amidst civil unrest in his homeland. Under his leadership, Nvidia transformed from a niche player in computer gaming chips into a powerhouse in data center technologies and autonomous vehicle systems.

In addition to his business achievements, Huang is known for his philanthropic efforts. He has donated $30 million to Stanford University for the construction of an engineering center and, in 2022, contributed $50 million to Oregon State University to establish a research center bearing his name.

With the ongoing antitrust investigation investors and industry watchers will be closely monitoring the developments in this probe and their potential impact on the company’s future.