The Federal Government of Nigeria has selected 23 fund managers to oversee the $10 billion Nigeria Global Investment Fund (NGIF).

According to a presentation document seen by Nairametrics, this ambitious fund aims to attract both international and local capital into critical sectors of the Nigerian economy, including agriculture, manufacturing, energy, infrastructure, and fintech.

The NGIF, established by the Federal Ministry of Industry, Trade, and Investment, is a pivotal component of Nigeria’s industrial revitalization strategy, which seeks to transform the nation’s economic landscape by reducing its overreliance on oil revenues.

The fund is structured as an umbrella entity, housing multiple sub-funds, each dedicated to specific sectors critical to Nigeria’s development.

55 applications received for fund managers

The selection of fund managers followed a rigorous evaluation process overseen by the Securities Exchange Commission (SEC).

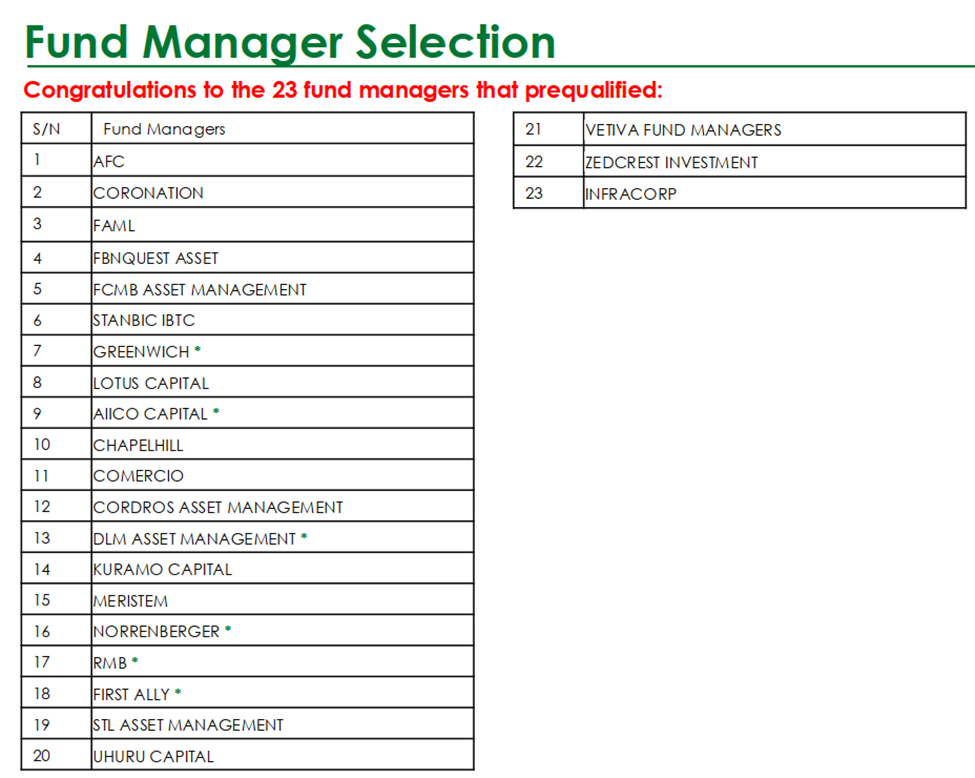

Out of 55 applications, 23 fund managers were chosen based on criteria such as their experience in managing public-sector partnerships, financial stability, international investment expertise, and adherence to Environmental, Social, and Governance (ESG) principles.

The fund managers include prominent names such as AFC, Coronation Asset Management, Stanbic IBTC, AIICO Capital, FBNQuest Asset Management, and more.

These fund managers will each oversee specific sub-funds within the NGIF, which has been structured to house 14 distinct sub-funds and 49 individual funds.

The 14 sub-funds under the NGIF will focus on the following priority sectors: Automotive/Light Manufacturing, Agriculture, Pharmaceuticals/Healthcare, Oil & Gas, Energy, Fintech/Banking, Heavy Industries, Real Estate, Mines/Solid Minerals, Creative Economy/Tourism, Aviation, Infrastructure, Education, and IT.

Each sub-fund is tasked with raising an average of $500 million, contributing to the overarching goal of raising $10 billion in the first phase of the NGIF.

The selected fund managers are aligned with these priority sectors based on their expertise and experience. For instance, Greenwich Asset Management, Coronation Asset Management, and Meristem Wealth Management are aligned with sectors such as Real Estate, while FBNQuest Asset Management and InfraCorp are focused on Infrastructure. Each fund manager will not only raise funds but also ensure that investments are strategically deployed to maximize impact across these sectors.

Support from Afreximbank

- In addition to selecting fund managers, the government has also secured significant backing from Development Finance Institutions (DFIs) such as the African Export-Import Bank (Afreximbank), which has committed a $3 billion country risk guarantee to de-risk the fund.

- There is an additional $2 billion earmarked for direct investments into key industries. This funding will support projects through mechanisms such as project finance, equity investments, risk insurance, and advisory support, further strengthening the NGIF’s capacity to drive economic transformation.

- The NGIF is poised to play a crucial role in bridging Nigeria’s significant infrastructure gap, estimated to require $14.2 billion in annual investment over the next decade.

- By mobilizing private capital, the fund will target sectors identified as having the highest potential for economic transformation and job creation.

- This fundraiser is part of a broader agenda to create a $1 trillion economy within the next ten years, as outlined in Nigeria’s Renewed Hope Agenda.

What you should know

- In April 2024, Nairametrics reported that the Federal Ministry of Industry, Trade and Investment (FMITI) invited eligible firms to indicate interest in providing services as Nigeria Diaspora Fund managers.

- This was based on an announcement made by Minister of Industry, Trade and Investment, Doris Nkiruka Uzoka-Anite, on her X account. ,

- According to the minister, these fund managers will be responsible for the development and establishment of a multi-sectoral, multilateral, private sector-led investment fund to form the $10 billion Nigeria Diaspora Fund.

- It was also reported that the ministry extended the deadline for companies interested in managing the $10 billion Diaspora Fund to apply. The deadline was moved from May 6 to May 13, 2024.