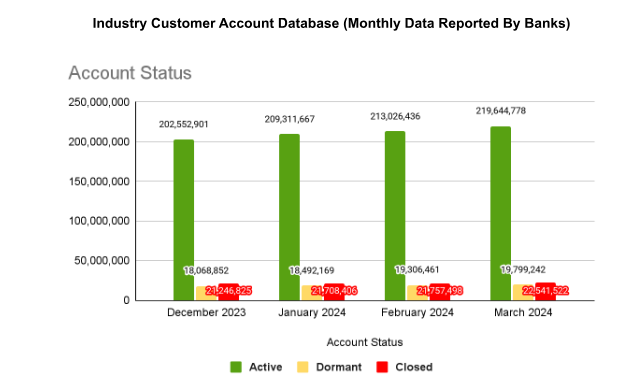

The number of active bank accounts in Nigeria jumped to 219.6 million in March 2024, marking a significant increase when compared with the previous data released by the Nigeria Inter-Bank Settlement System (NIBSS).

Earlier this year, NIBSS released the number of account numbers for 2022, which showed that there were 151 million active accounts bank accounts in the country at the end of that year. Fast forward to March 2024, the latest figure indicates that bank accounts have increased by 68.6 million in the last 15 months.

The data also shows that at the end of 2023, active bank accounts stood at 2022.6 million, meaning that about 17 million new accounts have been opened across the banks between January and March this year.

Dormant accounts

According to NIBSS, the number of inactive or dormant bank accounts in the country stood at 19.8 million. This is, however, a significant decline compared with 2022 figure the number of inactive accounts was put at 72.8 million.

An inactive or dormant account is a bank account that has had no activity on it for 12 months. Banks convert accounts with no activity for a long period into inoperative or dormant accounts to curtail the risk of fraud. By segregating the accounts, banks bring to their workers’ attention the risk involved in these accounts and call for their due diligence.

Similarly, the NIBSS data shows that the number of bank accounts that have been closed stood at 22.5 million.

Bank accounts vs BVN

Meanwhile, the number of active bank accounts in the country as of March shows that there is still a very wide gap between the number of accounts and the number of Bank Verification Numbers (BVN), which is now a compulsory requirement for opening an account.

The NIBSS database shows that total registered BVNs by account owners stood at 61.5 million as of April 2, 2024. However, industry analysts believe that the difference may not be much given that multiple accounts can be linked to a single BVN.

According to Enhancing Financial Innovation and Access (EFInA) Access to Financial Services in Nigeria 2023 Survey report, 5% (3 million) of banked adults do not have a BVN or NIN.

Recall that the Central Bank of Nigeria (CBN) in December last year announced that it would freeze accounts without a BVN and National Identification Number (NIN) from April 2024.

In a circular by the apex bank, it instructed banks to place a “Post no Debit” restriction – which prevents customers from making withdrawals, transfers, or any other debits “for all existing Tier-1 accounts/wallets without BVN or NIN”.