Dr. Bunmi Bajomo, Head, Group Corporate Banking and Chief Operating Officer, Ecobank Transactional (ETI) has said that the MPC’s resolution to elevate the cash reserve requirement from 32.5% to 45% positions Nigeria as the country currently boasting the highest CRR globally.

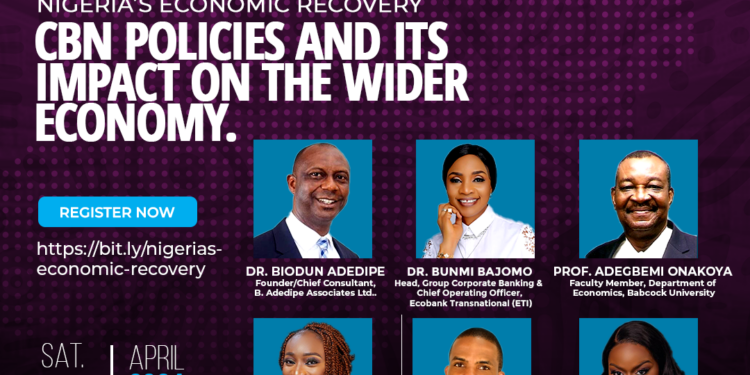

Bajomo stated this at a Webinar on ‘Nigeria’s Economic Recovery: CBN policies and its impact on the wider economy’ organized by Nairametrics.

She noted that from an investor’s standpoint, two significant policies have attracted considerable attention within the investing community besides the flotation of the currency via the January 29th circular.

- “Firstly, the Monetary Policy Committee’s decision to raise policy rates by 400 basis points, followed by an additional 200 basis points, culminating in a rate of 24.75%.

- Secondly, the MPC’s resolution to elevate the cash reserve requirement from 32.5% to 45% has positioned Nigeria as the country with the highest CRR globally,” she said.

Two noteworthy indicators

According to her, two noteworthy indicators emerge from these developments.

Bajomo noted that the implementation of increased cash reserve requirements resulted in the withdrawal of approximately N1 trillion from the economy.

She added that the adjustment of interest rates, following the Monetary Policy Rate (MPR) increases, signals to the investing community that the central bank is prepared to raise interest rates.

Bajomo noted that it’s important to note that the negative interest rate differential has been a persistent challenge in previous circulars and policy initiatives.

Negative yield environment

She said that comparing Nigeria with global and regional peers in West Africa, a significant negative yield environment has deterred serious investments.

- ”Mind you, the negative interest rate differential or the negative interest rates has been the bane of all of the previous circulars, all of the policy initiatives, because looking at it and comparing ourselves with the rest of the world or even our immediate neighbors across West Africa, no serious investments would come in in an environment of significant negative yield,” she said.

Bajomo noted that what the MPR adjustment has done is to narrow significantly the negative yield that had been prevailing.

She highlighted that Nigeria has observed a notable trend in investment flows, specifically Foreign Portfolio Investment (FPI), amounting to $2.3 billion between January and February.

According to her when compared to the total sum of $3.9 billion that the nation achieved last year, the figure is quite significant.

SME sector

Bajomo noted that the volatility experienced in the economy was partly attributable to the flotation of the currency, which lacked immediate support from necessary indicators. However, recent developments suggest a shift towards a more positive sentiment.

She noted that while these initiatives are commendable, it’s important to acknowledge potential collateral damage in the SME sector due to the contentious issue of high borrowing costs compounded by substantial exchange rate depreciation.

- “However, overall, the trajectory appears positive. Anticipated outcomes include a gradual moderation of inflation, which may remain elevated in the short term throughout the first half. Looking ahead, the combination of exchange rate stabilization and fiscal adjustments is expected to contribute to this moderation,” Bajomo said.