The International Monetary Fund (IMF) has urged the federal government to fully eliminate subsidies for fuel and electricity, highlighting that these financial supports are not only expensive but also ineffective in benefiting the populations most in need of assistance.

Although not explicitly mentioned, the underlying implication of removing these subsidies is a likely surge in the prices of electricity and fuel.

This is because current subsidized rates are thought to be significantly below the actual market prices. By phasing out these subsidies, the government would allow fuel and electricity prices to align more closely with their true market value, potentially leading to increased costs for consumers.

What the IMF is saying

The institution stated this in its latest press release on Nigeria titled “IMF Executive Board Concludes Post Financing Assessment with Nigeria.”

The bank also acknowledged the reforms currently embarked on by the current administration such as fuel subsidy removal and the unification of the exchange rate.

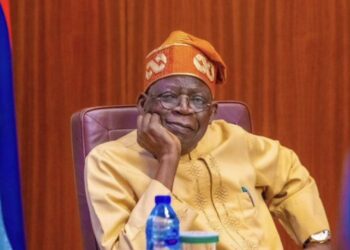

- “President Tinubu has moved ahead with important structural reforms: removing fuel subsidies and unifying the various official foreign exchange windows. He appointed a Presidential Fiscal Policy and Tax Reforms Committee to make proposals for raising domestic revenue to support investments in infrastructure, health, and education.”

On fuel and electricity subsidies, the IMF stated that the government had decided to partially reverse fuel subsidy removal by capping retail prices and electricity prices respectively, as a way to slow down inflation. It also cited the government’s decision to suspend VAT on diesel as another inflation reduction move.

- “To ease the impact of rapidly rising inflation on living conditions, the government has released cereals from the grain reserve, provided subsidized fertilizer to farmers, capped retail fuel and electricity prices—thus partially reversing the fuel subsidy removal—implemented a civil service wage award, and suspended the VAT on diesel.”

However, in its assessment, the IMF opined the fuel and electricity subsidies need to be removed to allow market forces to determine the prices. Instead, it recommended that the government focus on revenue generation and digitization of public service delivery as a strategy for reducing fiscal deficits.

- “The government’s focus on revenue mobilization and digitalization would improve public service delivery and safeguard fiscal sustainability. The envisaged reduction in the overall deficit in 2024 would help contain debt vulnerabilities and eliminate the need for CBN financing.”

Based on these recommendations, the IMF suggested that electricity and fuel subsidies be phased out completely.

- “Temporary and targeted support to the most vulnerable in the form of social transfers is needed, given the ongoing cost-of-living crisis. Fuel and electricity subsidies are costly, do not reach those that most need government support, and should be phased out completely.”

What this means

The IMF believes some of the reforms of the government have been a huge step in the right direction, however, it wants the government to go further by taking off subsidies completely to complement reforms of the monetary policy.

- The IMF recommendations are a direct message to the government to increase the prices of electricity and fuel to reflect the actual market prices of both products.

- For example, electricity prices have not increased since 2022 despite the depreciation of the naira and the increase in inflation, two major items that influence electricity prices.

- In addition, fuel prices have remained largely stable despite higher oil prices, and currency depreciation.

Despite these recommendations from the IMF, implementing such reforms demands a considerable degree of political determination from the government to persuade the Nigerian populace that these adjustments are implemented with a degree of compassion and consideration for the economic challenges many are currently enduring.

- Since the onset of the Tinubu administration, the economic landscape has witnessed significant shifts, exemplified by petrol prices tripling and the exchange rate depreciating by over 50%.

- These stark realities underline the necessity for the government to ensure that the proposed reforms, particularly those involving subsidy removals, are perceived as having a “human face” to mitigate the impact on citizens already grappling with economic difficulties.

In addition, labour unions are expected to continue their advocacy for wage increases, especially in the context of any economic reforms that entail the removal of subsidies.

This adds another layer of complexity to the situation, as the government must navigate the delicate balance between advancing necessary economic reforms and addressing the immediate financial concerns of its workforce.

Why does this sound like the IMF is only worried about recovery of loans rather than the well-being of Nigerians…I wonder why the IMF keep suggesting hardship for Nigerians with suggesting any reasonable solutions to the inflation and hardship

Those are the consequences of taking repeated loans from the IMF. They do not really seem to care if the population go up in smoke, so long as the country generates enough revenues to repay their loans plus interests. I have said several times that the IMF needs to stop giving loans to corrupt governments because they (IMF) know that most of the loan amount would be embezzled and misappropriated, while still placing the repayment burden on the poor wretched masses through increased taxes, subsidy removal etc. The IMF should use their loans to enforce financial discipline and public accountability in corrupt countries like Nigeria which should not only ensure the loans are repaid as at when due, but also enable the masses to truly benefit from the economic impact of such loans.

As Government continues to increase electricity, fuel prices and import duties more businesses will shutdown, price of goods and services will increase, unemployment will do up, hunger, disease and depression will go up. Until Nigerians raise up and take back what’s left of the nation.

We are no more enjoying fuel subsidy