Following the recent announcement of GlaxoSmithKline’s (GSK) departure from the Nigerian pharmaceutical market, there has been a notable surge in the prices of GSK medications, with increases reported to be as high as 1000%.

The significant rise in the cost of these medicines has sparked widespread concern among Nigerians, many of whom have expressed their frustrations on social media platforms.

The escalating prices can be attributed to a combination of factors: the withdrawal of GSK, a major player in the pharmaceutical industry, and the burgeoning rate of inflation in Nigeria.

According to the National Bureau of Statistics (NBS), Nigeria’s inflation rate as of October 2023 stood at 27.33%, the highest recorded since August 2005. This persistent upward trend in inflation has been a key driver in the rising costs of various goods and services, including pharmaceutical products.

The compounded impact of Nigeria’s increasing inflation rate and GSK’s exit from the local market has had a substantial effect on the affordability and availability of medicines, posing significant challenges for healthcare in the country.

GSK exit

On August 3, GlaxoSmithKline (GSK), a prominent UK-based pharmaceutical company, communicated to its Nigerian branch, GSK Consumer Nigeria Plc, its decision to discontinue the direct commercialization of its prescription medicines and vaccines in Nigeria.

- The company announced a strategic shift towards utilizing a third-party direct distribution model for its pharmaceutical products within the country.

- GSK attributed this significant change to a range of operational challenges. Primary among these was the difficulty in maintaining a steady supply of GSK drugs in the Nigerian market.

- Additionally, the company faced considerable hurdles due to the scarcity of foreign exchange, which adversely affected its capability to manage and settle foreign currency-denominated trade payables with its product suppliers.

- Furthermore, GSK identified several external factors influencing its decision.

These included the prevailing insecurity in the region, the government’s decision to remove fuel subsidies, and the overall high cost of conducting business in Nigeria. These elements collectively contributed to GSK’s strategic realignment in the Nigerian pharmaceutical market.

Consequences on the Nigerian pharmaceutical market

Following GlaxoSmithKline’s (GSK) announcement, traders of pharmaceutical products report that there has been a noticeable scarcity of GSK drugs across the country.

- Nairametrics has also observed significant challenges faced by community pharmacies, particularly in Lagos, in procuring various GSK medicines, attributing this difficulty primarily to the decreased availability of these drugs.

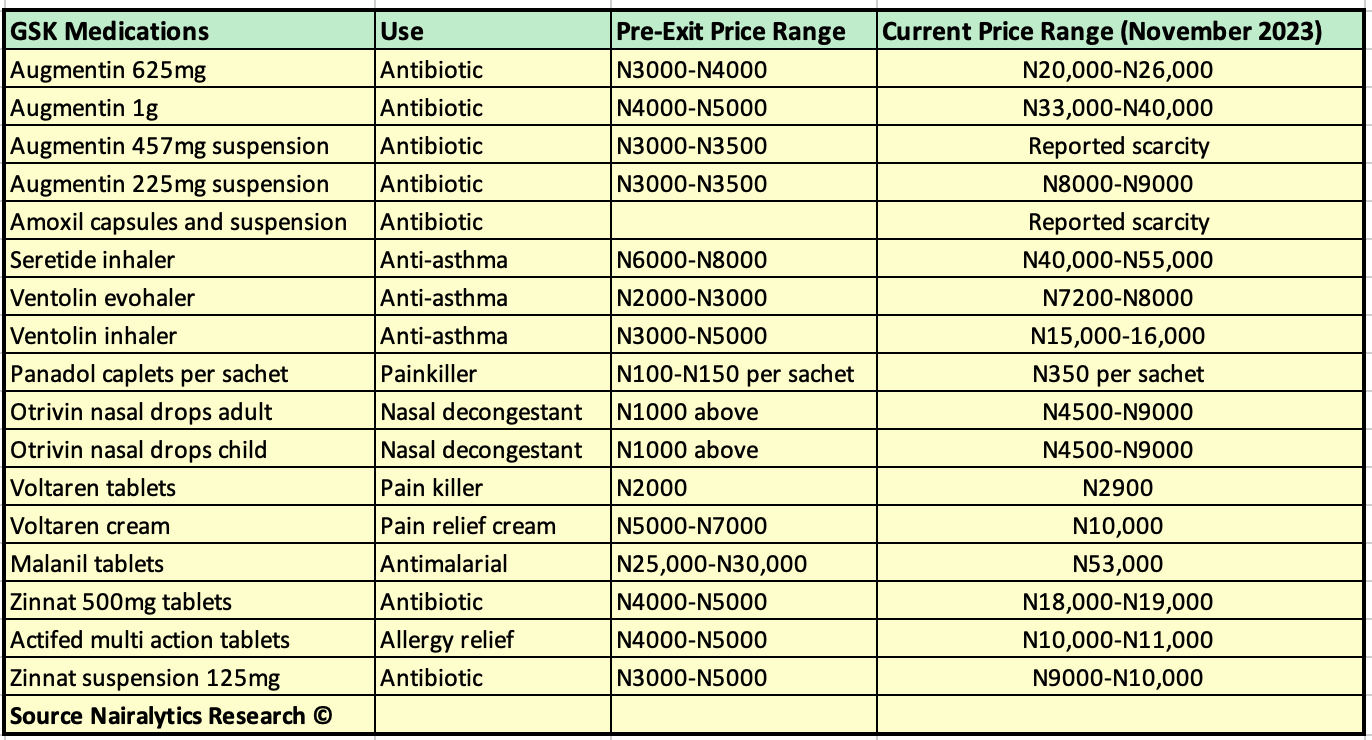

- To illustrate the impact of this development, Nairametrics has compiled a comparison of the current prices (as of November 2023) with those before GSK’s exit, focusing on some of the most commonly used GSK medications.

This comparison highlights the disparities and provides a clear picture of how the market has been affected by the company’s strategic withdrawal.

Reactions

Nairametrics conducted interviews with community pharmacists to delve into the causes of the recent surge in drug prices, customer reactions, and their expectations from the government.

- One pharmacist stated, “Prices are soaring because of the major issue of the foreign exchange rate, then companies that left Nigeria, for instance, GSK, and they control most of the market products, something Nigerians are not really aware of. We also have companies planning to leave so there will be more shortage of medicines leading to price increase.”

- Another added, “The scarcity of these medicines creates an increase in demand which leads to an increase in prices of medicines. If these companies left the country and directly imported medicines, they wouldn’t be this expensive, but based on exchange rates and certain government policies on importation, that’s why they are expensive.”

All the pharmacists interviewed pleaded anonymity as they feared victimization by industry stakeholders some of whom do not encourage speaking to the media about prices.

- Discussing customer behaviour, a pharmacist remarked, “Customers are now opting for cheaper brands, but there are some particular products that they just have to sacrifice for, like asthma medications. There are no options. Some have to cut down on feeding and supplements just to get medicines.”

- The sentiment among customers was further echoed by another interviewee: “Customers have been lamenting seriously. Some do not care to the point where they’ve stopped using their medicines regularly. They are looking for places where they would get discounted prices.”

Addressing government intervention, one pharmacist expressed, “We all want the government to work on the foreign exchange rate.

The dollar-to-naira rate is really impacting and affecting the lives and health of Nigerians.

They should also look for ways to entice these companies back while boosting our local pharmaceutical manufacturing companies like Emzor to fund these companies so they can get to a certain level of standard of operation.”

- Another pharmacist emphasized the need for accessible healthcare: “The government should also make healthcare available to all, especially in government hospitals so Nigerians can have access to more affordable drugs.”

Implications

According to the BMC Infectious Diseases Journal, there is a significant prevalence of antibiotic use in Nigerian hospitals, estimated at 78.2%. The journal notes that antibiotics produced by GSK are among the most frequently prescribed due to their proven efficacy.

- This high reliance on GSK’s antibiotics implies that Nigerians facing common bacterial infections will now encounter increased medical expenses.

- In the context of respiratory illnesses, the journal highlights that asthma impacts between 14% to 18% of the general population in Nigeria, with a notable prevalence among adolescents.

- Given GSK’s role as the primary and trusted supplier of asthma medications, its exit from the Nigerian market is resulting in increased costs for asthma patients.

This situation is exacerbated by the current economic challenges and the scarcity of these crucial medications.

WE WAISTED 8 YEARS WITH BUHARI FOR REAL

It’s getting a lot worse even drugs that are from indigenous companies.

GSK medications are for the elites. Their exist will even allow other generic companies to thrive in Nigeria. One doesn’t need GSK medications to be well. Unilever exited Nigeria home care products. We now have many players in skin care and home products. This article is just funny and ridiculous.