The recent NGX report on domestic and foreign portfolio participation in the Nigerian equities market indicates that foreign portfolio investors are disinterested in the country as the equities market recorded a net FPI deficit of N32.3 billion in the first eight months of 2023.

Specifically, a total of N2.42 trillion worth of transactions was recorded between January and August 2023, 28.1% higher than the N1.89 trillion recorded in the same period of 2022.

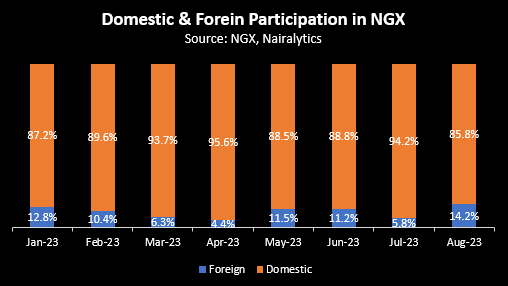

The breakdown of the data showed that foreign investors accounted for only 9.2% of the total trade while domestic players contributed 90.58%.

Foreign participation declined in the review period compared to 15.97% contribution recorded in the previous year, suggesting low interest in the Nigerian market, further tightening FX liquidity in the economy.

In nominal terms, foreign transactions dropped by26.1% from N301.4 billion recorded in 2022 to N222.78 billion in the period under review, while domestic transactions surged to N2.19 trillion from N1.59 trillion.

Market activities falls sharply in August

The total of trade recorded in the local bourse amounted to N262.56 billion in August, indicating a 62.7% decline compared to N702.98 billion traded in the previous month.

It is worth adding that the amount traded in the review month, represents the lowest since April 2023.

- On a year-to-date basis, total transactions have grossed N2.42 trillion, in contrast to the comparable period of 2022 at N1.89 trillion.

- The Nigerian market had enjoyed a bullish year so far, largely driven by domestic market participation as the All-Share Index has gained about 30% year-to-date as of September 2023. However, the market dipped slightly by 0.25% in September as trading starts to regress.

- The slight dip in September, coupled with the record-high inflation rate (25.8%), may indicate growing concerns about economic challenges and their potential impact on the stock market.

More monies are living the country

A further analysis of the data from the NGX showed that N23.37 billion was recorded as foreign outflows in August 2023 as against N13.79 billion inflows.

This points to a scenario where foreign investors are withdrawing their investments from the Nigerian equities market rather than increasing their stakes in the local bourse.

So far in 2023, a sum of N127.52 billion have been recorded as outflows compared to N95.26 billion inflows, indicating a net deficit of N32.26 billion for the market.

The declining inflows of foreign portfolio investment in the Nigerian stock market continues to impact on the broad economy as FX illiquidity has further widened the gap between the official and the parallel market.

Naira has been trading at the region of N1000/$1 mark in the last two weeks, while official rate at the Investors and Exporters window has averaged N757.7/$1, representing a disparity of about N243.

The persistent outflows of FX and the lack of inflows could see the disparity widen further if swift actions are not taken from the monetary and fiscal side of things to incentivize foreign inflows into the Nigerian economy.

I believe that foreign investors will be ready to bring money as soon as the Central Bank sorts out the problems of credibility and liquidity. Right now nobody in his senses will bring capital to a country where they can bring money but not take it back.