Egypt and United Arab Emirates have signed a currency swap deal worth around $1.4 billion in a move to help the North African country ease its economic crisis.

According to a report by Bloomberg, this deal will allow the central banks of both Arab countries exchange their local currencies up to 5 billion dirhams and 42 billion Egyptian pounds.

Egypt Currency Crisis

Bloomberg also reports that Egypt is battling its worst foreign-currency squeeze in years.

The North African country devalued its currency three times since early 2022, which saw it loose almost half its value against the dollar.

The International Monetary Fund (IMF) urged Egyptian authorities to allow for true flexibility in the currency before the institution can lend more money under a $3 billion rescue program.

According to Bloomberg Ecomonist, Ziad Daoud,

- “With inflation already at a record high, Egypt is unlikely to devalue the currency before the presidential election in December.

- But the country doesn’t have the means to sustain the status quo for much longer. After the vote, authorities will either let the pound weaken, or impose draconian import restrictions.”

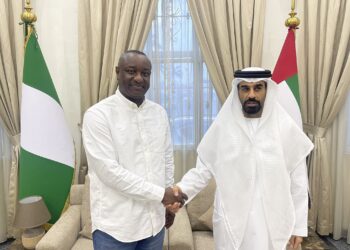

Egypt Partnership with Nigeria

Nairametrics had reported that The Central Bank of Nigeria, CBN signed a FinTech collaboration agreement with the Central Bank of Egypt.

In reports from the Egyptian media platform, the MoU with the Central Bank of Nigeria (CBN) would help foster the exchange of expertise in the realms of fintech, innovation, e-payment solutions, and financial inclusion.

The agreement was signed during the “Seamless North Africa 2023” conference at the Egypt International Exhibition Center in New Cairo, Egypt.

The then Deputy Governor of CBN, Mrs. Aishah Ahmad said the partnership would deepen cross-border regulatory collaboration, and information sharing, boost innovation and grow regional technology investments.

According to her:

- “We look forward to cultivating an innovative space for fintech startups and entrepreneurs in Egypt and Nigeria to accelerate financial inclusion, deepen our payment systems and drive economic growth across the African Continent.”