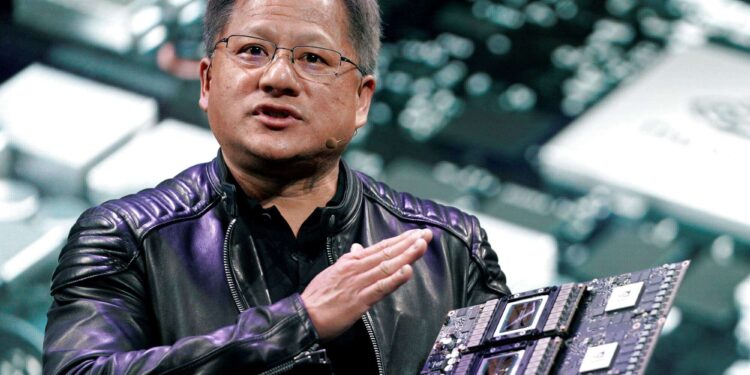

Nvidia’s CEO, Jensen Huang, is placing a substantial bet on the ongoing artificial intelligence (AI) surge, expecting it to extend well into 2024.

In an interview with Reuters, Huang identified two primary factors fueling the increasing demand for AI technologies.

Two trends shaping AI demand

- First, there’s the growing reliance on AI-generated content across diverse sectors, from legal documents to marketing materials.

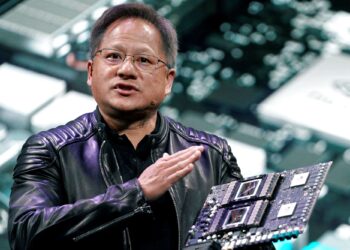

- Second, there’s the pivotal shift away from traditional data centres, which were originally designed around central processors, to the adoption of Nvidia’s robust chips as the new cornerstone.

- “These two fundamental trends are what’s behind everything that we’re seeing, and we’re about a quarter into it,” he said. “It’s hard to say how many quarters are ahead of us, but this fundamental shift is not going to end. This is not a one-quarter thing.” Huang explained.

Nvidia has had plenty to smile about lately as its sales forecasts surpassed Wall Street’s expectations on Wednesday.

The company also made a strategic move to buy back an additional $25 billion worth of its shares, an action typically taken when a company’s leadership believes it is undervalued.

This confidence is founded on the fact that Nvidia’s stock price has more than tripled over the past year, and it appeared poised to reach an all-time high following the latest financial results.

Addressing concerns about the sustainability of the AI frenzy, Nvidia announced plans to bolster hardware production well into the next year.

This decision effectively quashed doubts raised by a few analysts who questioned the duration of the AI wave.

Notably, Nvidia maintains a near-monopoly on the computing systems that power services like ChatGPT, OpenAI’s widely used generative AI chatbot.

- “We possess excellent visibility throughout this year and into the next. We are already in the planning stages for next-generation infrastructure, collaborating closely with leading cloud computing firms and data centre builders,” Huang shared with investors during a conference call, Reuters noted.

More insight

Jensen Huang’s move to buy back stock, even when its price is at an all-time high, showcases a level of confidence that surpasses most other tech companies’ AI investments.

Although Nvidia’s price-to-earnings multiple recently dropped from 60 to around 43 after analysts upgraded their earnings estimates, this move signals a strong belief in the company’s continued growth potential.

While Microsoft significantly increased its capital expenditures, which included investments in Nvidia hardware, and committed $10 billion to OpenAI, other major players like Meta Platforms and Amazon.com’s cloud computing unit, AWS, have collectively invested tens of billions of dollars in AI-related hardware and products.

The surging demand for Nvidia’s chips has provided the company with substantial financial strength. During its second quarter, Nvidia reported that its adjusted gross margins nearly doubled to an impressive 71.2%.

In an overnight turn of events, the billionaire tech CEO, Jensen Huang, saw his wealth soar, adding over $4 billion to his fortune.

According to the Bloomberg Billionaires Index, Huang’s net worth climbed from $38.8 billion on August 20 to an impressive $42 billion by the close of play on August 21.

Background

Nvidia Corporation, founded in 1993 by Jensen” Huang, Curtis Priem, and Chris Malachowsky and based in Santa Clara, California, is a tech leader known for its graphics processing units (GPUs).

It was created when the founders saw the need for dedicated GPUs to advance computer graphics, particularly in gaming, as CPUs alone could not handle the demands of 3D graphics.

Over the years, Nvidia transitioned into high-performance computing (HPC) and artificial intelligence (AI), repurposing their gaming GPUs for these applications.