President Bola Tinubu on Thursday ordered the suspension of the 5% excise duty on telecommunications as well as the Import Tax Adjustment levy on certain vehicles.

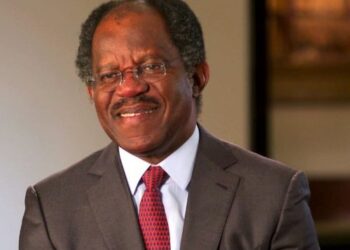

This came as the President signed four executive orders into law to curb arbitrary taxation policy in the country. Special Adviser, Special Duties, Communication and Strategy, to the President, Dele Alake, announced the policy directive on Thursday during an interactive session with State House Correspondents.

Among the Executive Orders signed into law by the President, includes the change in the date of the implementation of the Finance Act, 2023. The President deferred the commencement date of the changes contained in the Act from May 23, 2023, to September 1, 2023.

This is to ensure adherence to the 90 days minimum advance notice for tax changes as contained in the 2017 National Tax Policy.

Need for review

Briefing the correspondents on why President Tinubu is reviewing some of the tax policies signed by his predecessor, Muhammadu Buhari, Alake said:

- “You will all recall that prior to the advent of this Administration, certain tax changes were introduced via the Customs, Excise Tariff (Variation) Amendment Order, 2023 (henceforth referred to as “the Order”) published on the 8th of May 2023 and the Finance Act, 2023, which was signed into law on the 28th of May 2023.

- “Among others, the Order introduced new Excise Duty on Single Use Plastics (SUPs), higher Excise Duties on some locally manufactured products, including alcoholic beverages and tobacco products, and Green Tax by way of Import Tax Adjustment on certain categories of imported vehicles.

- “The Tinubu Administration has since noticed that some of the tax policies are being implemented retroactively with their commencement dates, in some instances, pre-dating the official publication of the relevant legal instruments backing the policies. This lacuna has created some challenges of implementation.”

- He noted that the intentions behind upward adjustments of some of the taxes are quite noble as they were designed to raise revenue as well as address environmental and public health concerns. However, they have generated some significant challenges for affected businesses and elicited serious complaints amongst key stakeholders and in the business community.

- “Let me mention some of the problems we have identified with the aforementioned tax changes. A document known as the 2017 National Tax Policy approved by the Federal Executive Council of the last administration prescribes a minimum of 90 days’ notice from the government to tax-payers entities before any tax changes can take effect.

- “This global practice is done with a view to giving taxpayers and businesses reasonable time to adjust to the new tax regime. However, evidencing part of the gaps pointed out earlier, both the Finance Act 2023 and the Customs, Excise Tariff Order 2023 did not give the required minimum notice period, thus putting businesses in violation of the new tax regime even before the changes were gazetted,” he added

Alake noted that as a result of this, many of the affected businesses are already contending with the rising costs, falling margins and capacity underutilization due to the various macroeconomic headwinds as well as the impact of the Naira redesign policy.

According to him, the Excise Tax increases on tobacco products and alcoholic beverages from 2022 to 2024, which had already been approved, are also being implemented. But a further escalation of the approved rates by the current Administration presents an image of policy inconsistency and creates an atmosphere of uncertainty for businesses operating in Nigeria.

- “The Excise Tax of 5% on telecommunication services has generated heated controversy. There is also a lack of clarity regarding the status of this tax, just as players in the sector also complain about the imposition of multiple taxes on their operations.

- “We have also seen that the Green Taxes, including the Single Use Plastics tax and the Import Adjustment Levy on certain categories of vehicles, require more consultation and a holistic approach to the country’s net zero plan in a manner that does not impact the economy negatively,” he said.

What’s there to show what they have been doing with the previous tax money they collected?. They want more so that their stomach will continue to grow more fatter,shame on the so call tax collectors. In a good countries,you wil see how the citizens taxes are been used,good health insurance,,good hospitals,constant electricity nation wide,paying teachers and other government officials well so that our children can enjoy their education. In Africa,Nigeria is doing very bad in terms of health care,good structure of schools,road,very bad,abi na electricity,dat one na dead matter. Electricity is now for the rich ones. It will take the special grace and intervention of God to reform Nigeria as a nation again.

People that was suggesting 5% more,can we start by asking them to provide their tax receipts?.