- President Bola Ahmed Tinubu affirms his commitment to the removal of fuel subsidy and unification of Nigeria’s exchange rates, stating that these measures will enhance the country’s competitiveness and attract foreign investments.

- Tinubu emphasizes the importance of sectors such as infrastructure, health, energy, and agriculture, which offer significant investment potential.

- Tinubu meets with representatives from Afreximbank and the European Bank for Reconstruction and Development, receiving support for his reform efforts and expressing Nigeria’s readiness for business and investment.

President Bola Ahmed Tinubu has expressed his commitment to sustaining the removal of fuel subsidy and the unification of Nigeria’s exchange rates, as these measures are expected to contribute to the creation of a more competitive economy in the country.

He made this statement on Thursday, June 22, during a conversation with a delegation from the Africa Export-Import Bank (Afreximbank) at the ongoing Summit for New Global Financing Pact in France. The President emphasized that a competitive Nigeria would attract Foreign Direct Investments (FDIs), thus enhancing the country’s economic growth.

More Policies to come

President Tinubu further stated that his administration would continue to implement policies that stimulate the economy and support investments in sectors where Nigeria holds a competitive advantage. He specifically highlighted the significance of Nigeria’s infrastructure, health, energy, and agricultural sectors, which he believes offer great potential for investments.

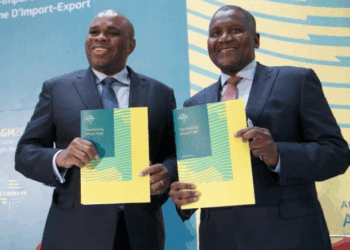

In his interaction with the Afreximbank delegation, led by Dr Benedict Oramah, the President and Chairman of the Board of Directors at AfreximBank, Tinubu urged them to seize the business opportunities available in Nigeria.

He said:

- “We are ready for business, prepared to welcome investments. We need reforms for national survival. We must stimulate recovery for the growth and prosperity of our people, which will not be far away. Nigeria is ready for global business and our reform is total.”

AfreximBank support

In response, Dr. Oramah, the President of AfreximBank commended President Tinubu for the bold steps in removing the fuel subsidy and unification of the exchange rate. He assured Tinubu of full support from AfreximBank as he works to reform the economy.

Dr Oramah also said Afreximbank was already building the first African Specialist Hospital in Abuja, and Energy Bank, pledging to inject more money into the economy to further build the confidence of investors.

Meeting with the European Bank for Reconstruction and Development (EBRD)

President Tinubu also met with the President of the European Bank for Reconstruction and Development (EBRD), Odile Renaud–Basso. During the meeting, he called attention to the fact that Nigeria is ready to open up its economy for business.

Tinubu said:

- “We are challenged in terms of reforms, and we have taken the largest elephant out of the room with the removal of fuel subsidy, and multiple exchange rates are equally gone. We are determined to open up the economy for business.

- “Consider us a stakeholder in the Bank. Ignoring Nigeria will be a peril to the universe.”

In response, Renaud-Basso said it would be a mistake for the development bank not to invest in Nigeria, after considering six potential economies for investment. According to her, the EBRD’s focus would be on the private sector, especially Small and Medium Scale Enterprises (SMEs).