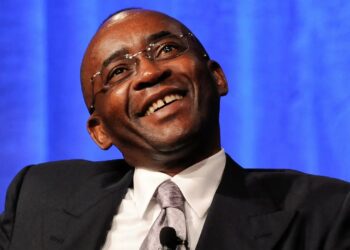

- Aliko Dangote retains his position as Africa’s richest person for the 12th consecutive year, with a net worth of $17.8 billion.

- The depreciation of the Nigerian naira against the dollar resulted in a $3.12 billion decrease in Dangote’s fortune, despite strong performance in local investments.

- Dangote’s conglomerate, Dangote Industries, encompasses various companies, including Dangote Cement and Dangote Sugar, along with investments in United Bank for Africa.

Nigerian businessman Aliko Dangote remains Africa’s richest person for the 12th year in a row, even as his fortune fell by $3.12 billion to $17.8 billion amid the unification of the naira’s exchange rate system.

The 66-year-old Kano-born billionaire has fallen from 74th to 94th richest person in the world. This is the steepest daily drop ever recorded by the Nigerian billionaire on the Bloomberg Billionaires Index.

Impact of naira exchange rate and investment performance

At the close of trading in Lagos on Wednesday, the naira fell 29% to N664 to the dollar, according to local exchange operator FMDQ. The central bank of Nigeria earlier set a sell-dollar exchange rate for exporters and investors at N610.20, 22% below Tuesday’s price.

The billionaire’s fortune moderated in dollar terms even as the local stock market and government bonds rose as investors welcomed the latest prospects of President Bola Tinubu’s string of reforms. Most of Dangote’s fortune comes from 86% of the listed Dangote Cement shares.

He owns shares in the company directly and through his conglomerate, Dangote Industries. The $19 billion refinery currently commissioned by President Buhari is not yet operational and thus is not included in the valuation.

Dangote’s business ventures and assets

Currently, Dangote Group’s main listed companies are Dangote Cement, Dangote Sugar, and Nascon Allied Industries.

Dangote’s other public assets include shares in Dangote Sugar, Nascon Allied Industries, and United Bank for Africa. The company’s interests in public companies are held directly and through his Dangote Industries, which also includes closely related companies engaged in food manufacturing, fertilizer, petroleum, and other industries.

Dangote’s fertilizer plant is capable of producing up to 2.8 million tons of urea per year. Its net worth is based on discounted cash flow analysis by KPMG. This rating was confirmed by an external analyst.

The magnate also owns six residential and commercial properties in Lagos. These will be valued using a capitalization method using rental income provided by Dangote spokesperson Anthony Chiejina and CBRE Broll Nigeria’s valuation rate.

The company’s cement equities rewarded investors who take positions in Dangote Cement shares in 2020 and exited on June 31, 2023, with a return of 140.26% through price appreciation and more than 11% in the first half of 2023.

For its 2022 earning results, the company paid a dividend of N20.00 per share, which has led to a new bid for its shares.

In case you missed it

As Nairametrics previously reported, Alhaji Aliko Dangote is set to earn a total of N293.960 billion in dividends for 2022. This represents a significant portion of the total N506.071 billion dividend compilation, accounting for approximately 58.09% of the total amount.

The dividend earnings for Alhaji Aliko Dangote reflect his substantial ownership and involvement in Dangote Cement and Dangote Sugar Refinery, two prominent companies in Nigeria’s industrial sector.