- The capital market is assessing the broad-based costs of fuel subsidy removal to listed companies, according to analysts at Coronation Research.

- These costs will be borne by companies across the board, potentially leading to increases in direct costs or demands for salary increases.

- Companies that may face challenges include those dependent on discretionary spending, while telecom companies and banks may continue to perform well due to inelastic demand for their products.

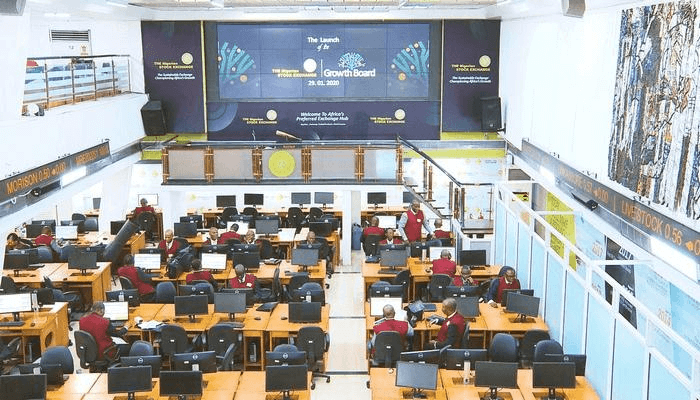

Financial analysts at Coronation Research have said that the capital market is beginning to assess the broad-based costs of fuel subsidy removal to listed companies.

The analysts stated while reacting on the implication of fuel subsidy removal to listed companies in their report themed ‘Investment Opportunities from Fuel Subsidy Removal” and seen by Nairametrics.

They noted that these costs will be borne by companies across the board, whether in the form of increases in direct costs or response to demands for salary increases.

- “The stock market was enthused by the announcement of fuel subsidy removal, with the NGX All-Share Index gaining 5.23% the day after it was announced.

- Since then, the market has been more circumspect with barely any further gain in the index overall. We believe the market is beginning to assess the broad-based costs of fuel subsidy removal to listed companies.

- Ultimately, these costs will be borne by companies across the board, whether in the form of increases in direct costs or response to demands for salary increases. One way or another, fuel price rises will work their way into the cost base.

- It is unlikely that companies will respond with immediate salary increases so we expect the consumer to be hit in pocket. After the disruption caused by cash shortages early this year, the first half of 2023 is a tough one for the Nigerian consumer,” the analysts said.

They noted that given that the consumer will be under pressure, they have reservations about companies that benefit from discretionary spending.

According to them, brewers and some consumer product companies may face challenges adding that companies that may continue to perform well are those whose products enjoy inelastic demand, notably telecom companies and banks.

- “It is often said that the fuel subsidy is a subsidy for the wealthy, in particular those who drive cars. This ignores the fact that many domestic generators are fueled with petrol rather than diesel, in particular small domestic generators in widespread domestic and commercial use.

- Transport costs are not only borne by those who drive cars but by users of buses, taxis, and okada motorbike taxis. Transport costs are reflected in the costs of fresh food, packaged food, and almost all other goods. It is fair to say that fuel price removal is an inflationary shock for everyone,” they said.

Beneficiaries of the fuel subsidy removal

They noted that the first beneficiary of fuel subsidy removal was the Federal Government of Nigeria (FGN).

- “In 2022 the FGN’s budget for fuel subsidy was N4.0 trillion (US$8.6 billion), which represented 22.1% of its total budget of N18.1 trillion (US$39.0 billion). The subsidy swallowed up 40.1% of budgeted aggregate FGN revenues of N9.97 trillion.

- Doing away with fuel subsidies has positive implications for Nigeria’s fiscal deficit, which was budgeted at N8.17 trillion (US$17.6bn) in 2022.

- The government-owned NNPC’s purchases of petroleum products take the form of swaps, of the NNPC’s crude oil for imported products, with petroleum (until 31 May) sold at subsidised Naira prices,” they said.