Article Summary

- Abdulsamad Rabiu’s net worth is now $8.24 billion, making him one of the billionaires on Bloomberg’s wealth list.

- He is the founder and chairman of BUA Group, which includes subsidiaries such as BUA Cement and BUA Foods.

- BUA Foods reported strong sales growth in the first quarter of 2023, leading to impressive net profit for the company.

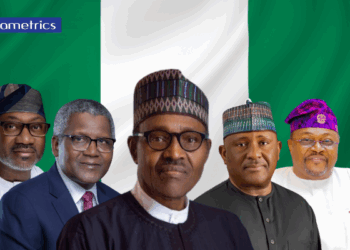

With a net worth of $8.24 billion, Abdulsamad Rabiu is now on Bloomberg’s elite wealth list with his fellow compatriot and Africa’s richest man, Aliko Dangote, ($21.1 billion).

Since the company’s shares were listed on the Nigerian Stock Exchange a year ago, his net worth has grown from $4.9 billion to $8.24 billion at the time of writing this report.

Rabiu’s large stakeholdings

Rabiu is the founder and chairman of the Nigerian conglomerate BUA Group. Its Lagos-based subsidiary, BUA Cement, is the country’s second-largest cement producer, with sales of N361 billion (US$847 million) in 2022 alone.

Another listed subsidiary, BUA Foods, has Nigeria’s largest noodle and flour factory. He controls a 93% stake in BUA Foods.

According to Bloomberg, a large chunk of Rabiu’s fortune comes from shares in BUA Cement. He owns about 98% of the company’s shares directly and through three other companies, according to its first quarterly report for 2023 and annual report for 2022.

The activities of BUA Sugar Refinery Limited, BUA Oil Mills Limited, IRS Flour, IRS Pasta, and BUA Rice Limited are all included in business activities.

What you should know

BUA Foods Plc reported 60.2% year-on-year sales growth, driven by sales growth across its five divisions, in its first quarter 2023 financial results ended March 31, 2023. reported 144.3 billion Naira. Start from the US department. The cost of sales increased by 42.0% year-on-year to N87.7 billion due to higher raw material and energy costs.

Operating expenses increased 299.8% year-on-year to N8.9 billion. This was primarily due to a sharp increase in selling expenses as the Company entered new markets and sought creative ways to meet the challenges of the macroeconomic environment.

Bua Foods’ funding costs also increased by 28.6% year-on-year to Naira 2.1 billion. Still, the strong sales performance allowed the company to achieve impressive net profit.

His PBT in the first quarter of 2023 was at Naira 45.9 billion, an increase of 85.0% over the same period in 2022. Meanwhile, PAT in Q1 2023 increased by 77.1% year-on-year to N40.5 billion.

About the Bloomberg Billionaire Index

Launched in March 2012, the Bloomberg Billionaires Index is a daily ranking of the 500 richest people in the world based on net worth.

It is based on information from stock market events, economic indicators, and news reports, contains profiles of each billionaire, and includes tools that allow users to compare the wealth of several millionaires. increase. The index is updated daily with New York closing prices.