Key highlights

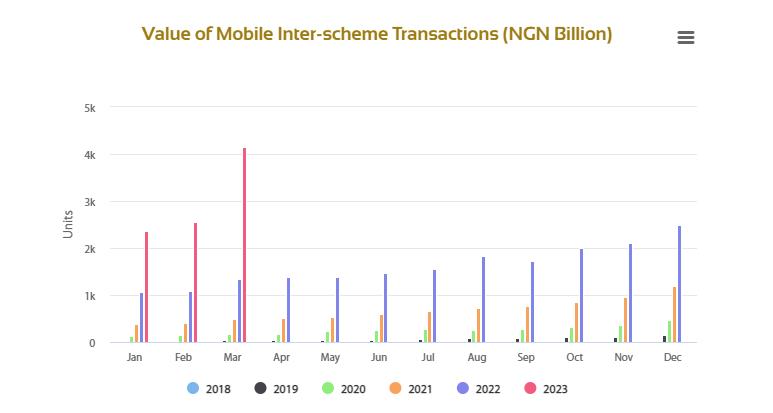

- Transactions over mobile rose by 215% to N4.1 trillion in March this year as Nigerians faced cash scarcity.

- This came as the highest-ever monthly transactions recorded on the mobile platform.

- Meanwhile, the cash scarcity has continued as most bank ATMS remain empty.

Pushed by the scarcity of cash, Nigerians transferred a total of N4.1 trillion over mobile in March 2023. This pushed transactions over the platform to record a 215% increase of over N1.3 trillion recorded in the same period last year.

This came as the highest-ever monthly transactions recorded on the mobile platform and nearly double the record of February this year, which stood at N2.5 trillion.

According to the latest electronic transactions data released by the Nigeria Inter-Bank Settlement Systems (NIBSS), the volume of mobile transactions also jumped by 794% in the month. The volume of transactions in March this year stood at 380 million compared with the 42.5 million recorded in the same period last year.

Instant payments surge

Expectedly, the value of the NIBSS Instant Payments (NIP) increased by 52% to N48.3 trillion in March 2023, up from N31.8 trillion in the same period in 2022. It also increased by 31%% when compared with the previous month’s figure of N36.8 trillion.

The volume of NIP transactions rose by 192% year on year to 1.1 billion, up from 402 million in March of last year.

Cash scarcity persists

Although electronic payments have maintained steady growth over the years, the surge in value and volume of mobile transactions witnessed this January could be attributed to the naira scarcity, which commenced towards the end of January this year.

Despite the intervention of the Supreme Court and its March 3 ruling on the new naira notes design compelling the CBN to allow the old N1,000, N500, and N200 notes to remain legal tender until December 31 this year, there was no full compliance by banks until late March.

Meanwhile, Nigerians have continued to experience scarcity of cash despite the release of old naira notes by the banks. Queues at the ATMs have refused to end even weeks after the country returned to the old notes. It would appear the banks are still in short supply of the old naira notes while the new ones are becoming scarcer by the day. Nairametrics observed that most ATMs, especially in Lagos, remain empty, while there are long queues at the few ones dispensing cash.

Cash withdrawal limit to sustain e-payment growth

While the scarcity of the naira is expected to ease with the announcement from the Central Bank of Nigeria (CBN) declaring that the old N1,000 and N500 will continue to be legal tenders until the end of this year in compliance with the recent Supreme Court ruling, the revised cashless policy, which limits the amount of cash that can be withdrawn by individuals and corporate organizations will further drive a surge in electronic transactions across the country.

- According to the new policy which followed the redesigning of N1,000, N500, and N200 notes, effective from January 9, 2023, cash withdrawal by an individual is now limited to N500,000 a week, while corporate organizations have an N5 million withdrawal limit in a week.

- Amid the scarcity of the new notes, banks have also configured their ATMs to allow a maximum of N20,000 withdrawal per person in a day.