Key highlights

- Peter Obi said he is not aware of any letter of apology from the British government or any of its agencies over his detention by immigration officials at Heathrow Airport in London.

- Labour Party also said it did not issue any statement to that effect and will continue to examine any dubious or political motive, on the part of the perpetrators of the identity theft.

- It stated that Peter Obi and the LP/PCC have since moved on from the incident and continue to be totally focused on the legal processes before the Election Petition Tribunal.

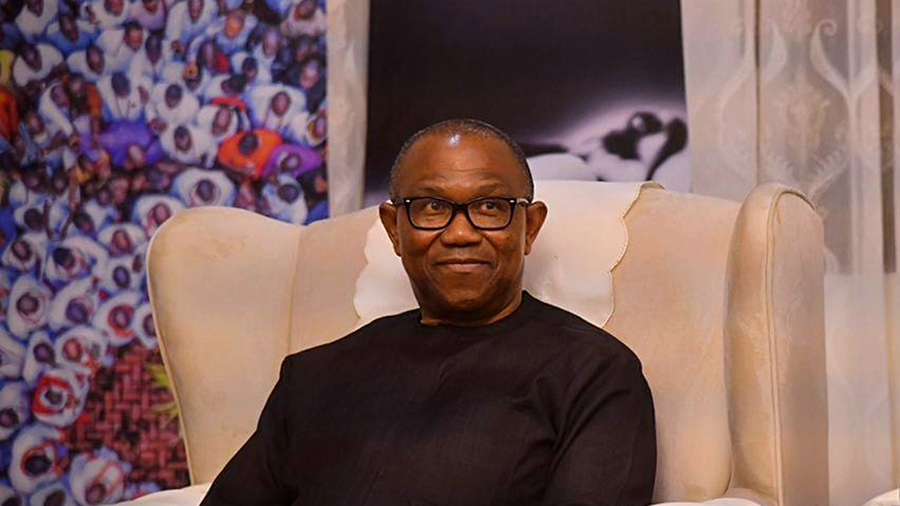

The Presidential candidate of the Labour Party (LP) in the February 25 presidential poll, Peter Obi, has denied receiving any apology from the British government or any of its agencies over his detention by immigration officials at Heathrow Airport in London.

The reaction follows reports of a purported apology by the British government to Peter Obi over his detention at the airport when he visited London during the Easter period.

This was made known in a statement issued by the Head, Media and Communications of the Obi-Datti Presidential Campaign Council, Diran Onifade.

Not aware of any apology

The statement from Onifade reads,

- “We have been receiving enquiries with regards to a so-called apology, purportedly issued by the British Government or any of its agencies, to our Principal Mr Peter Obi, in respect of a routine Immigration engagement with him, as he arrived London, for a brief visit, last Friday, the 7th of April.

- “We would like to state emphatically that we are not aware of any such apology, and have not issued any statement whatsoever, in that regard.

- “While we continue to examine any dubious or political motive, on the part of the perpetrators of the identity theft,

- “We have every confidence in the ability of the British authorities to resolve the matter, to a conclusion.

- ‘’Mr Peter Obi and the LP/PCC have since moved on from the incident and continue to be totally focused on the legal processes before the Election Petition Tribunal towards the recovery of our mandate, which we are firmly convinced, was overwhelmingly expressed by voters, in the Presidential election of February 25th.”

In case you missed it

- Recall that a few days ago, the LP Presidential Campaign Council revealed that Peter Obi, was harassed and detained by the United Kingdom (UK) immigration authorities at Heathrow Airport during the Easter break over offences believed to have been committed by an imposter.

- Onifade said that the LP Presidential Candidate who is just back from London, where he celebrated Easter, was saved by the spontaneous reaction of Nigerians at Heathrow Airport who witnessed the incident.

- However, in the midst of the controversy, the Spokesperson of the Atiku Abubakar presidential campaign, Daniel Bwala, said the British government apologised to Obi over his detention at Heathrow Airport.

- Bwala on his official Twitter account wrote, “British government apologised to Peter Obi for illegally serving him a detention note.

- “Can you now put a ‘respek’ on his name? We are now waiting for the US government to apologise to Tinubu for illegally collecting the forfeited dollars.

- “Asiwaju fans oya start throwing the insults.”