Recent developments in the banking sector over the naira redesign and the scarcity of naira notes have left many Nigerians having second thoughts about leaving their money with commercial banks. Fintechs, on the other hand, are now becoming the better option as they do not charge their customers for keeping their money as the banks do.

Before now, the fintech ecosystem has been revolutionising access to finance and banking services. The potential in these digital banks has seen global venture capitalists pumping their funds into fintechs in Nigeria.

As more fintechs spring up by the day, the market is becoming highly competitive as the target customers now have many choices from the array of companies offering innovative financial services via mobile apps.

Interestingly, as more Nigerians embrace the fintech apps for their convenience and easy access to financial services on the go, the ones with the better services are rewarded with more customers. And this can often reflect in how many people are downloading their apps.

The Nigerian fintech apps are available on both the iOS App Store and the Google Play Store. However, Nairametrics took a look at their downloads figure on Google Play Store, as the iOS Store does not show the number of downloads.

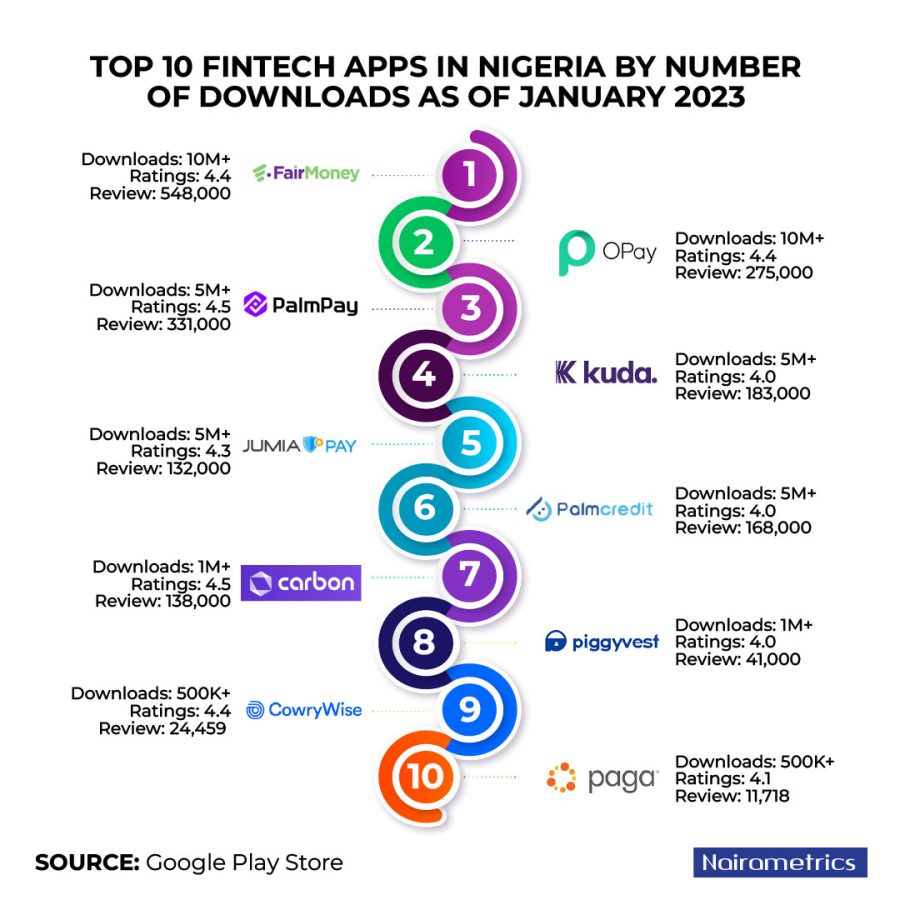

Here are the top 10 fintech apps in Nigeria by the number of downloads as of January 2023.

10. Paga

Paga is a mobile money solution that offers transfers, bill payments, top-ups, and even remittance services. The company says it has over 17 million users and is accessible to unbanked, offline users through a mobile money agent network as well. However, on Google Play, the Paga app still has less than a million downloads.

- Downloads: 500k plus

- Rating: 4.1

- Reviews: 11,718

9. Cowrywise

Launched in 2017, Cowrywise is a fintech app that offers savings with interest rates at periodic, fixed and one-time rates. With this app, you can build your savings and investment portfolios and manage your money securely. It also allows you to save as an individual or with a group. A notable highlight of Cowrywise is the friendly user interface and the ‘Savings Challenge’, which challenges you to engage in rigorous savings plans that help you build emergency funds or a better stash of funds at the end of the specified period.

- Downloads: 500k plus

- Rating: 4.4

- Reviews: 24,459

8. Piggyvest

PiggyVest provides its over 3 million customers with savings and investment tools, but it’s not exactly a full-fledged digital bank. The company offers fixed, flexible, goal-oriented, and automated savings options, as well as pre-vetted low-medium risk primary and secondary investment avenues for 6 – 12 months.

- Downloads: 1 million plus

- Rating: 4.0

- Reviews: 41,000

7. Carbon

Carbon is a CBN-licensed digital bank that also provides a loan facility and investment opportunities, in addition to usual digital banking features such as debit cards. Accounts are enabled for P2P payments, as well as bill payments and mobile recharges. Though the fintech company currently has over two million customers according to its website, its app on Google Play had been downloaded by one million-plus customer.

- Downloads: 1 million plus

- Rating: 4.5

- Reviews: 138,000

6. Palmcredit

Palmcredit is a fintech app in Nigeria owned by Newedge Finance Limited where users can get a loan without collateral. As one of the most downloaded fintech apps, there is no doubt that many Nigerians Nigerians are taking advantage of the loan services being provided through the app.

- Downloads: 5 million plus

- Rating: 4.0

- Reviews: 168,000

5. JumiaPay

The e-commerce company, Jumia, first introduced its JumiaPay app in 2016 and is now used to pay for more than 50 per cent of sales on the platform. The company also recently launched consumer loans on the app via collaborations with banks. Ranking as one of the most downloaded fintech apps on the Play Store, Jumia pay had garnered over 5 million downloads as of January.

- Downloads: 5 million plus

- Rating: 4.3

- Reviews: 132,000

4. Kuda

The fintech valued at US$500 million is fully licensed by the Central Bank of Nigeria (CBN). Although Kuda is based in London, it is currently focused on the Nigerian market. Kuda accounts come with a free debit card, budgeting and spending controls, and transfers and savings functions as well. The bank has also killed maintenance fees and provides users with a specific list of free transfers each month.

- Downloads: 5 million plus

- Rating: 4.0

- Reviews: 183,000

3. Palmpay

The Palmpay fintech app was first released in September 2018, according to information on Google Play. But a pilot phase was launched in July 2019 after the company secured a mobile money operator licence from the Central Bank of Nigeria (CBN). It officially became available to Nigerian users in November 2019.

- Downloads: 5 million plus

- Rating: 4.5

- Reviews: 331,000

2. OPay

Opera’s Africa fintech startup OPay launched its mobile money platform in Lagos in 2018 on the popularity of its internet search engine in Africa. OPay’s mobile money service gives users the ability to pay for utilities, make P2P transfers, and save as well. The company also offers an offline banking service through which users that don’t have smartphones can still carry out transactions.

- Download: 10 million plus

- Rating: 4.4

- Reviews: 275,000

1. FairMoney

FairMoney is a digital bank focused on lending. The company provides instant loans of up to one million nairas, as well as a bank account and a debit card. According to the company, FairMoney processes over 10,000 loans every day, with one loan disbursed every eight seconds. While it shares the same number of downloads and ratings with OPay, FairMoney has more user reviews, which places it ahead of OPay.

- Downloads: 10 million plus

- Rating: 4.4

- Reviews: 548,000

Bottomline

While other fintechs are doing very well in Nigeria whose services are not app-based, some of those running on apps now have more downloads than bank apps. Currently, none of the commercial banks in Nigeria has up to 10 million downloads on the Google Play Store, an indication that fintech apps gaining more traction.

Wow I never knew that fairmoney had more download than opay and kuda… Impressive stats

No cap.. FairMoney is doing very well 💯💯

Fair money is doing well but sometimes the network disturb