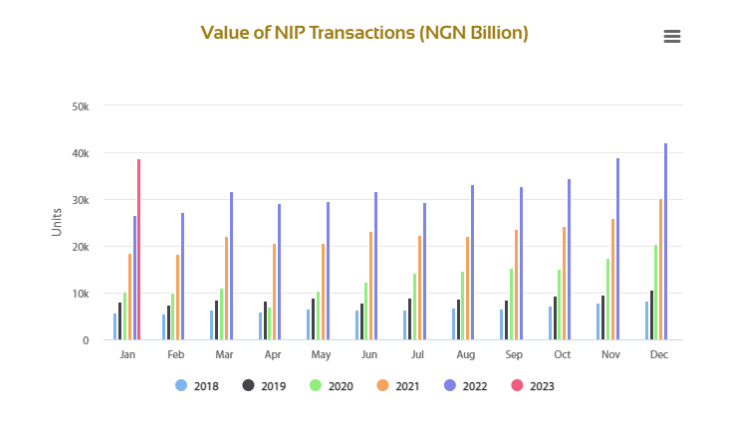

The Nigeria Inter-Bank Settlement Systems (NIBSS) has revealed that Nigerians spent a total of N38.7 trillion over electronic channels in January 2023.

The value recorded on the NIBSS Instant Payment (NIP) represents a 45% increase year on year when compared to the N26.6 trillion recorded in the same period last year.

While e-payment has been gaining traction in Nigeria over the years, more Nigerians were forced to go cashless towards the end of January as the first deadline for the old N200, N500, and N1,000 drew closer. The scarcity of cash in circulation also pushed many to various electronic payment channels.

The volume of NIP transactions processed by NIBSS for the month also jumped from 348 million in January 2022 to 541 million in January 2023. This represents a 55% increase year on year.

Naira scarcity to push further growth: As the Central Bank of Nigeria (CBN) continues to mop up cash in circulation through the naira redesign and the revised cashless policy, more Nigerians are now embracing electronic payment. This February, for instance, the scarcity of the naira notes is forcing many Nigerians to make payments via mobile transfers, PoS, and USSD, among others.

Even when naira scarcity is eventually, the revised cashless policy, which further limits the amount of cash that can be withdrawn by individuals and corporate organisations will further drive a surge in electronic transactions across the country.

- According to the new policy which followed the redesigning of N1,000, N500, and N200 notes, effective from January 9, 2023, cash withdrawal by an individual is now limited to N500,000 a week, while corporate organisations have an N5 million withdrawal limit in a week.

- Amid the scarcity of the new notes, banks have also configured their ATMs to allow a maximum of N20,000 withdrawal per person in a day.

Infrastructure under pressure: Meanwhile, the recent surge in electronic transactions as a result of the scarcity of cash is putting pressure on the existing payment infrastructure in the country. This has led to an increase in the number of failed transactions across platforms.

While many banks are currently having issues with their mobile apps as a result of the surge, the rate of PoS transaction failure has also increased. Instances of customers being debited and not getting value are now rampant with electronic transactions.

Sources within the Nigerian banks have also acknowledged that the surge in electronic transactions is putting pressure on their facilities as more Nigerians are on the networks at the same time. According to one of the sources, Nigerian banks would need to upgrade their IT infrastructure to withstand the level of current traffic being witnessed.

- “The current level of traffic we are having on apps is unprecedented and it is understandable because there is no cash, people have to use the next available means, which is the mobile app. Unfortunately, many bank apps in Nigeria do not have the capacity for the number of transactions we are witnessing at the same time right now. And this is why we have been having issues.

- “At this point, all banks will need to upgrade their apps’ capacity. We are already doing that on our end but it’s not something that can bring immediate respite. Things may have to get worse before it gets better because in the process of an upgrade, the customers will not be able to use their apps and this worsens the experience,” a source told Nairametrics.

About NIBSS NIP: The NIBSS Instant Payments (NIP) is an account-number-based, online real-time Inter-Bank payment solution developed in the year 2011 by NIBSS. It is the Nigerian financial industry’s preferred funds transfer platform that guarantees instant value to the beneficiary.

According to NIBSS, over the years, Nigerian banks have exposed NIP through their various channels, that is, internet banking, bank branch, Kiosks, mobile apps, Unstructured Supplementary Service Data (USSD), POS, ATMs, etc. to their customers.

Ok