President Muhammadu Buhari has said that all Federal Public institutions (FPIs) in the country must migrate their websites to the second-level domains, which include .gov.ng, .edu.ng, and .mil.ng; all under the country code Top Level Domain (ccTLD.ng).

With this directive, no Nigerian government-related website is expected to be on generic domains such as .com.

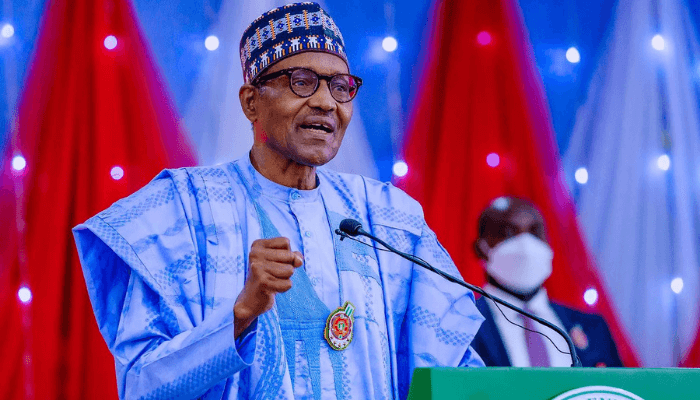

The President, who gave the order on Thursday during the inauguration of two new policies, also warned all government officials to refrain from using private emails for official purposes.

Importance of new policies: Note that the two policies that were inaugurated were developed by the Ministry of Communications and Digital Economy. They include the National Policy on Nigerian Government Second Level Domain and the National Data Policy.

While linking the two policies to the diversification and prosperity of the economy, President Buhari said the National Policy on the Nigerian Government Second-Level Domains and the National Data Policy are central to accelerating the development of the nation’s digital economy sector.

He added that the Federal Government would continue to develop policies and programmes in furtherance of the diversification of the economy. He said:

- “In the last three and a half years, we have intensified the development of policies, design of programmes and implementation of projects in the digital economy sector and the impact has been very impressive. “For example, we have succeeded in diversifying our economy to a large extent.

- “And this is obvious when we consider the contribution of the ICT sector to our Gross Domestic Product (GDP) in the second quarter of 2022 which stood at 18.44%, compared to the contribution of the oil sector to the GDP which was 6. 33% in the same period.”

The backstory to the policies: Earlier, Minister of Communications and Digital Economy, Prof. Isa Pantami said that the two policies being inaugurated were outcomes of compliance with the President’s directive to come up with a National Policy that was earlier approved by the Federal Executive Council.

He noted that the policies were targeted at consolidating the gains achieved so far in the digital ecosystem.

On the Second Level Domain policy, the Minister said the government came up with the policy because:

- “The use of generic domains and private emails for Government businesses and correspondences impedes the identity, security, and global recognition of the Nigerian Government on the Internet. Furthermore, the use of private emails for Government business is a major limitation to the capabilities to archive and back-up sensitive Government data thereby making it difficult to preserve historical correspondences and documents hosted on non-Government servers.

- “Similarly, Government documents that should be deleted or destroyed after a period of retention are permanently hosted on unsecure servers.”

He added that the Policy was developed to strengthen public confidence in the use of digital technologies and participation in the digital economy.