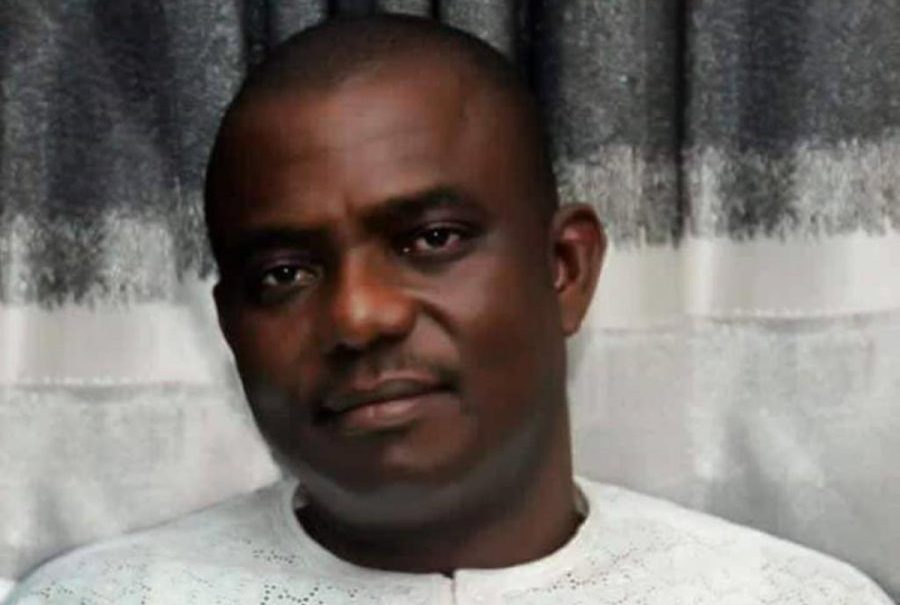

The National Operations Controller at the Independent Marketers Association of Nigeria (IPMAN), Mike Osatuyi, has assured that Nigerians will likely see more fuel availability in the next two weeks.

Mr Osatuyi stated this during an interview on Arise TV’s Morning Show on Wednesday, February 1, as monitored by Nairametrics.

IPMAN’s assurance followed the crucial meeting held on January 31 with the Nigerian National Petroleum Company (NNPC) Limited and all other stakeholders across the downstream petroleum value chain. As Osatuyi pointed out, the meeting was successful and all stakeholders will work together to ensure the crisis comes to an end.

Nobody is perfect: During the interview, Mr Osatuyi said that all stakeholders have agreed to sell fuel at affordable prices to reduce the burden on Nigerians. According to him, no one in the value chain is clean when it comes to all the challenges causing the fuel crisis, as there are bad eggs across all strata of the system. However, they are willing to tackle the issues and make fuel available at reasonable prices.

Supply and smuggling challenges: Mr Osatuyi went further to state that more depots will be made available so more products can come into the country, he also addressed the issue of cross-border smuggling which the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) had earlier said was a major cause of the lingering fuel crisis.

He highlighted the fact that the Nigeria Union of Petroleum and Natural Gas Workers (NUPENG) needs to caution their members not to drive their fuel trucks across the borders into neighbouring countries.

Fuel costs across the country: Mr Osatuyi said that if fuel is sold to marketers at N180 per litre, and other costs are added, Nigerians could end up buying fuel at N210 to N220 per litre, which is better than N500 per litre, which some people are already buying the commodity in the country.

According to him, NUPENG has to agree on how much marketers will pay for transportation costs as this will also determine how much will be added to the depot pricing.

Issue of fuel subsidy/deregulation: While speaking on fuel subsidy, Mr Osatuyi said the government should encourage a massive importation of fuel, so the prices can reduce. He said IPMAN supports fuel subsidy removal, and he advised that whatever income is generated after subsidies are removed (about N7 trillion per year) from fuel, should be used to develop critical infrastructure and welfare of the citizens to eliminate suffering.

He also said when subsidies are removed, and refineries are working at full capacity, there will be no importation cost and Nigerians will buy fuel at better prices. He said:

- “We are ready to work with all stakeholders so that Nigerians can benefit. When the fuel subsidy is removed, the fuel cost will increase, but the money saved will be used for the benefit of Nigerians.”

For the record: Nigeria has one of the lowest fuel prices on the continent and this has led to unprecedented cross-border smuggling of fuel to other countries where fuel prices are higher. For instance, in Ghana, fuel is sold for 13.23 Cedis, which is about N487 per litre and in the Niger Republic, fuel is sold for 540 West African CFA Franc, which converts to N413.10 per litre.

Wonderful writeup,point blank

This is just talk until we see it. Nobody believes anybody anymore. Especially when it’s about the government and their cronies.

To say Nigeria has one the lowest fuel prices on the continent is good, but the comparison is faulty.

Nigeria could easily sell its fuel for even less, but for the sector’s strange magical acts fueled by political and stakeholder greed.

Nigeria could easily generate revenue from supplying the same continent with fuel. This comparison is rife because people have gotten used to the disorder and chaos. Any the iniquities thrive also because of the demand and supply tap that is without control.

This report repeatedly echos the same limp journalism that has over the years failed to bring sanity to our polity, Instead of cleaning your house of rubbish, you tell people that it’s better than a garbage dump.