The Central Bank of Nigeria (CBN) said that the concentration of fintech companies in Lagos State is slowing down the development of fintech across the country, especially in the hinterlands.

The apex bank identified this as a major challenge to financial inclusion in the country and fails to align with the National Fintech Strategy drafted by the National Financial Inclusion Steering Committee.

Note that the strategy, among others, was designed to drive a wider spread of fintech across the country, helping to achieve the country’s 95% financial inclusion target by 2024.

Why Lagos is attractive: Explaining why fintechs are concentrated in Lagos, the CBN noted that aside from the large size of the market, the State also has a higher GDP per capita than Nigeria. While the country’s GDP per capita is put at USD 2,229.9 (as of 2019) that of Lagos was put at USD 6,238.

- “Many Fintech businesses are focused on Lagos because of the size of the market; Lagos is the commercial capital of Nigeria with over 20 million inhabitants and a higher GDP/capita of USD 6,238. However, this has slowed Fintech development in the hinterland,” the CBN said.

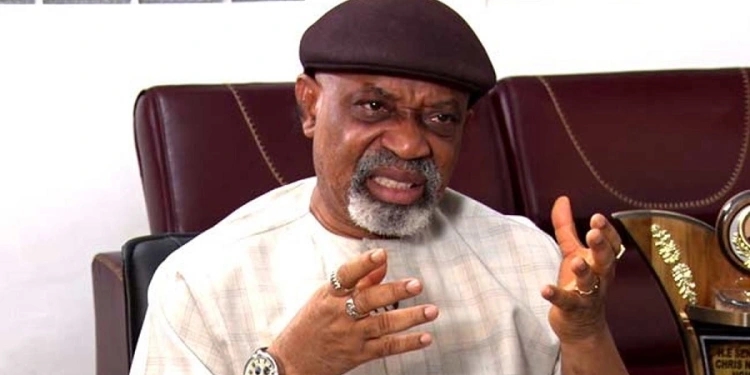

Need for fintech strategy: In his foreword to the strategy document, the CBN Governor, Godwin Emefiele, who is also the Chairman of the National Financial Inclusion Steering Committee, said the committee believes that fintech has the potential to facilitate inclusive growth in the Nigerian economy. He said:

- “In light of this, the national financial inclusion stakeholders developed a strategy to leverage fintech for inclusive growth and development, while enabling the Nigerian FinTech ecosystem for global competitiveness. The strategy seeks to achieve these objectives through the implementation of some key initiatives to catalyze the Fintech ecosystem. It highlights demand and supply side imperatives for harnessing and retaining the talent pool in the FinTech space and the mainstreaming of fintech into the Financial Service sector.

- “Furthermore, the document seeks to address issues that have militated against the growth of fin techs in Nigeria and will serve as a collaborative tool to maximize the benefit of FinTechs while mitigating the risk.”

According to the CBN Governor, the National Fintech Strategy is a major component of the Payment Systems Vision 2025 (PSV2025). He added that the strategy would enable the attainment of the objectives of the Nigerian Startup Bill, 2022, particularly in the Financial Services sector.

It’s not up to CBN to determine the development of Fintech companies in other places in Nigeria but the enabling environment and education .Lagos have always been the center of excellence and will always be.CBN should just provide the necessary tools if any other state wishes to thrive in this industry